MORE:

> 2016 press releases

MAIN POINTS

- World merchandise trade volume expected to grow by 2.8% in 2016, unchanged from 2.8% in 2015, as GDP eases in developed economies and picks up in developing ones.

- Trade growth should accelerate to 3.6% in 2017, still below the average of 5.0% since 1990. Risks to the forecast are tilted to the downside, including further slowing in emerging economies and financial volatility.

- South America recorded the weakest import growth of any region in 2015 as a severe recession in Brazil depressed demand.

- Exports of developed economies lagged behind developing countries in 2015, with 2.6% volume growth in the former and 3.3% in the latter.

- Developed economies imports surged last year while developing countries stagnated, with growth of 4.5% in the former and 0.2% in the latter.

- A sharp trade slowdown affected all regions in 2015Q2 but was mostly reversed by the end of the year.

“Trade is still registering positive growth, albeit at a disappointing rate,” WTO Director-General Roberto Azevêdo said. “This will be the fifth consecutive year of trade growth below 3%. Moreover, while the volume of global trade is growing, its value has fallen because of shifting exchange rates and falls in commodity prices. This could undermine fragile economic growth in vulnerable developing countries. There remains as well the threat of creeping protectionism as many governments continue to apply trade restrictions and the stock of these barriers continues to grow.”

“However, we should keep these figures in perspective. WTO Members can take a number steps to use trade to lift global economic growth — from rolling back trade restrictive measures, to implementing the WTO Trade Facilitation Agreement. This Agreement will dramatically cut trade costs around the world, thereby potentially boosting trade by up to $1 trillion a year,” Azevêdo added. “More can also be done to address remaining tariff and non-tariff barriers on exports of agricultural and manufactured goods.”

On the basis of the forecast for 2016, world trade will have grown at roughly the same rate as world GDP for five years (at market exchange rates), rather than twice as fast as was previously the case. Such a long, uninterrupted spell of slow but positive trade growth is unprecedented, but its importance should not be exaggerated. Overall, trade growth was weaker between 1980 and 1985, when five out of six years were below 3%, including two years of outright contraction.

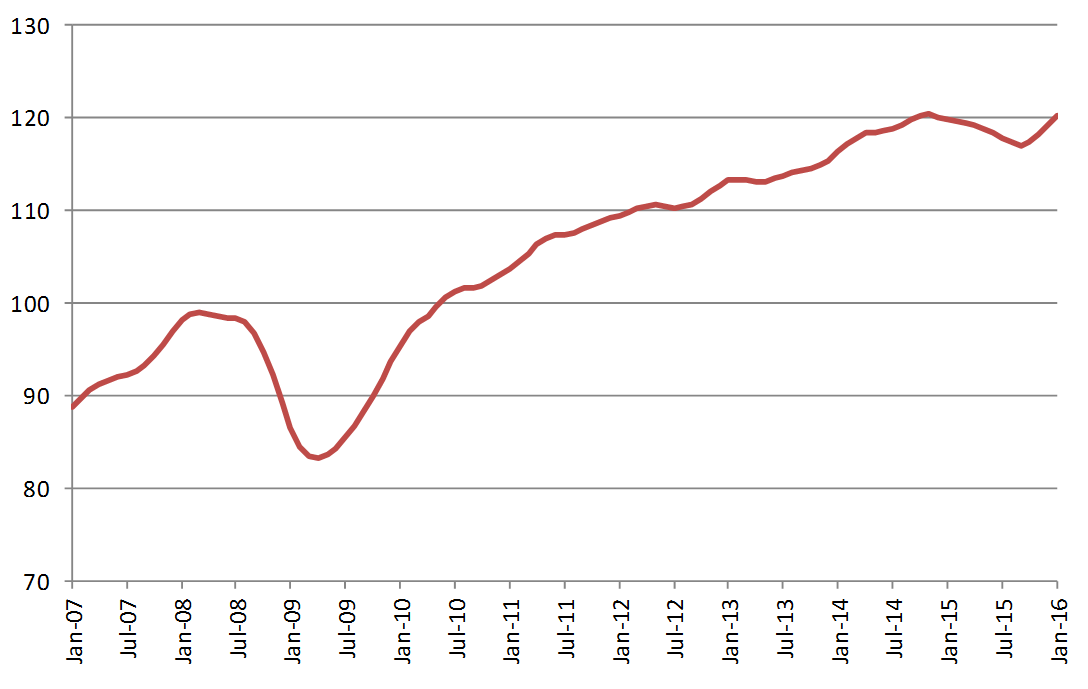

Alternative indicators of economic and trade activity in the opening months of 2016 are mixed, with some pointing to a firming of trade and output growth while others suggest some slowing. On the positive side, container throughput at major ports has recovered much of the ground lost to the trade slowdown last year, while automobile sales — one of the best early signals of trade downturns — have continued to grow at a healthy pace in developed countries. On the other hand, composite leading indicators from the Organization for Economic Cooperation and Development point to an easing of growth in OECD countries, and financial market volatility has continued in 2016. Therefore trade growth may remain volatile in 2016.

Details on trade developments in 2015

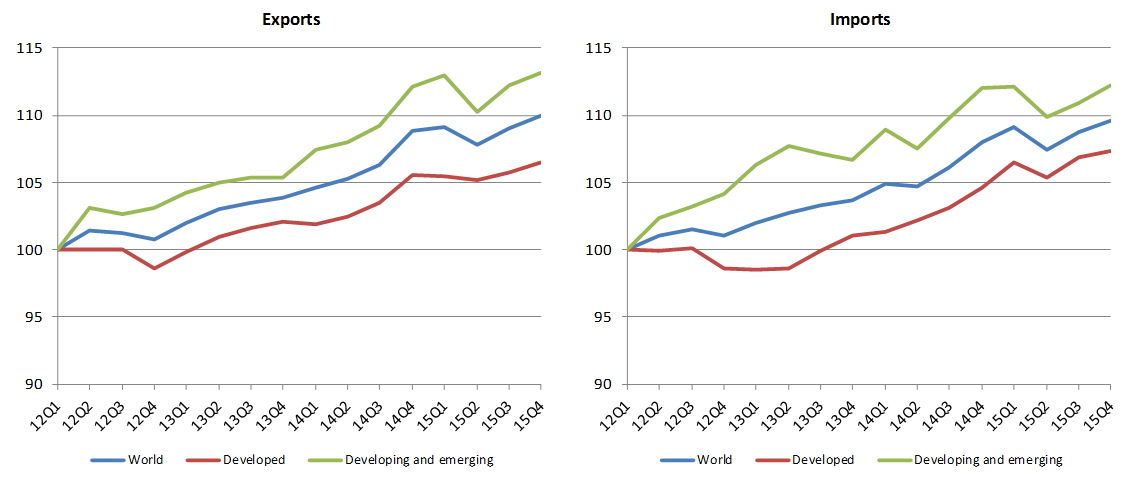

The 2015 result marks the fourth consecutive year in which growth in world merchandise trade stayed below 3.0% on an annual basis. Trade was also unusually volatile over the course of the year, falling in the second quarter in both developed and developing countries before rebounding in the final half (Chart 1).

Chart 1: Volume of merchandise exports and imports by level of development, 2012Q1-2015Q4

Source: WTO Secretariat

The weak but still positive growth of merchandise trade volume in 2015 contrasted with the sharp decline in the dollar value of trade, which fell 13% to $16.5 trillion, down from $19 trillion in 2014. (See Appendix Tables 1 to 6 for details on trade in current dollar terms by country and region). This discrepancy was mostly attributable to strong fluctuations in commodity prices and exchange rates, which were in turn driven by slowing economic growth in China, resilient fuel production in the United States, and divergent monetary policies across leading economies. Volatility in financial markets also dented business and consumer confidence and may have contributed to reduced global demand for certain durable goods.

World trade in commercial services last year registered a smaller decline in current dollar terms (exports down 6.4% to $4.7 trillion) than merchandise trade, with goods-related services such as transportation experiencing stronger declines (down 10.3% to $870 billion) than other categories. The relative strength of services is not surprising, since this type of trade tends to be less sensitive to business cycles than trade in goods.

The preliminary figure of 2.8% for world trade growth in 2015 refers to the average of merchandise exports and imports in volume terms, i.e. adjusted to account for differences in inflation and exchange rates across countries. This figure is in line with our most recent forecast of 2.8% from last September, but that forecast did not predict some regional developments.

Exports from North America came in below expectations, while shipments from oil exporting regions (Africa, Middle East and the Commonwealth of Independent States) were stronger than anticipated. Meanwhile, European imports were stronger than predicted while those of oil producing regions were weaker. The relative strength of Europe's trade can be explained by the recovery of intra-European Union trade, while the softness of oil producers' imports is explained by low oil prices, which deprive these countries of the export revenues that they need to pay for imports.

Negative import growth in South and Central America in 2015 was mostly due to the severe and ongoing recession in Brazil, although other distressed countries in the region contributed to the negative result as well. Meanwhile, the decline in imports of oil producing regions is mostly explained by the slide in world oil prices, which slashed these countries' export revenues.

Trade developments in 2015 by region, product and services category

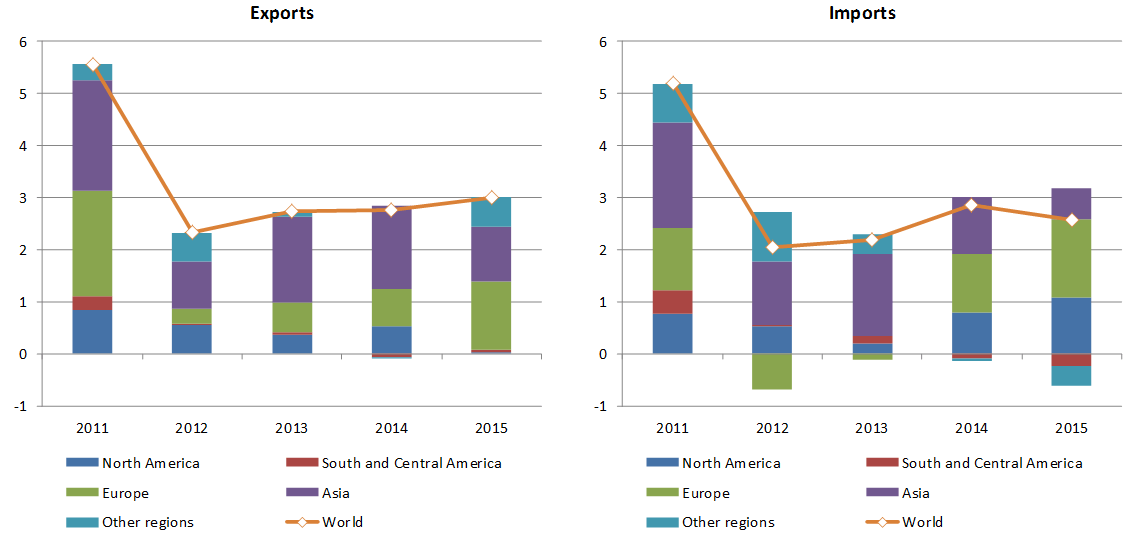

The volume of world merchandise trade has grown at a slow, steady pace in recent years, but this consistency belies changes in the contributions of WTO geographic regions to trade volume growth over time (Chart 3).

Asia contributed more than any other region to the recovery of world trade after the financial crisis of 2008-09. However, the region's impact on world import volume growth declined last year as the Chinese and other Asian economies cooled. Asia contributed 1.6 percentage points to the 2.3% rise in the volume of world merchandise imports in 2013, or 73% of world import growth, but in 2015 the region contributed just 0.6 percentage points to the global increase of 2.6%, or 23% of world import growth.

In contrast, Europe has mostly weighed down world trade since the financial crisis, actually reducing global import demand growth in 2012 (‑0.7%) and 2013 (‑0.1%). However, in 2015 Europe was again making a large positive contribution, accounting for 1.5 percentage points of the 2.6% increase in world import volume, or 59% of global trade growth. The gradual recovery of intra-EU trade in 2014 and 2015 was responsible for much of the rebound in Europe, as the drag exerted by the European sovereign debt crisis faded.

North America made a positive contribution to world import growth last year (1.1%), while negative contributions were recorded in 2015 for South and Central America (-0.2%) and Other regions, which covers Africa, the Middle East and CIS countries (-0.4%).

Chart 2: Contributions to world trade volume growth by region, 2011-2015

Annual % change

Source: WTO Secretariat

Asia also did more than any other region to lift merchandise export volume growth between 2011 and 2014, but its contribution fell below that of Europe in 2015. In the latest year, Asia was responsible for 1 percentage point of the 3.0% rise in world merchandise exports, or 35% of export growth, whereas Europe's 1.3 percentage point contribution accounted for 44% of the rise.

North America's contribution to exports growth in volume terms was close to zero in 2015 as demand for US goods slowed in Canada, Asia and South and Central America. Meanwhile, South and Central America and other regions made small positive contributions to export volume growth. The combination of increased export volumes in oil producing regions and falling imports in Asia likely contributed to falling energy prices in 2015, as oil supply outstripped energy demand, causing prices to plunge.

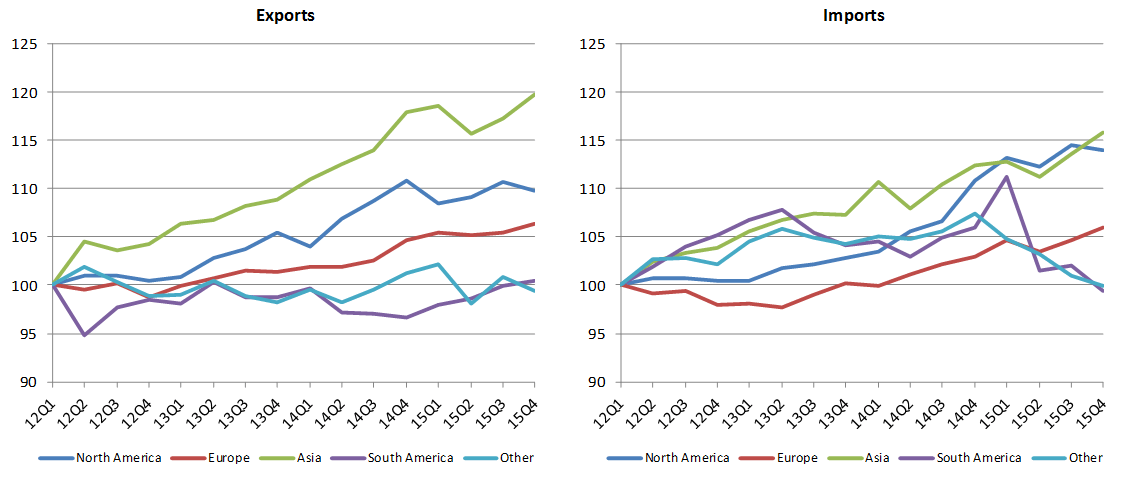

Chart 3 shows quarterly merchandise export and import volumes for the four years ending in 2015Q4. It highlights the fact that all geographic regions were affected to varying degrees by the trade slowdown in the first half of 2015, although the impact was strongest in the second quarter. Imports of resource dependent economies (mostly in South and Central America and Other regions) were squeezed by falling export revenues and did not see their imports recover in the second half of 2015, whereas imports of the more industrialized regions (Europe, North America, Asia) staged a partial recovery in the second half.

Chart 3: Volume of merchandise exports and imports by region, 2012Q1-2015Q4

(Seasonally adjusted volume indices, 2012Q1=100)

Source: WTO Secretariat

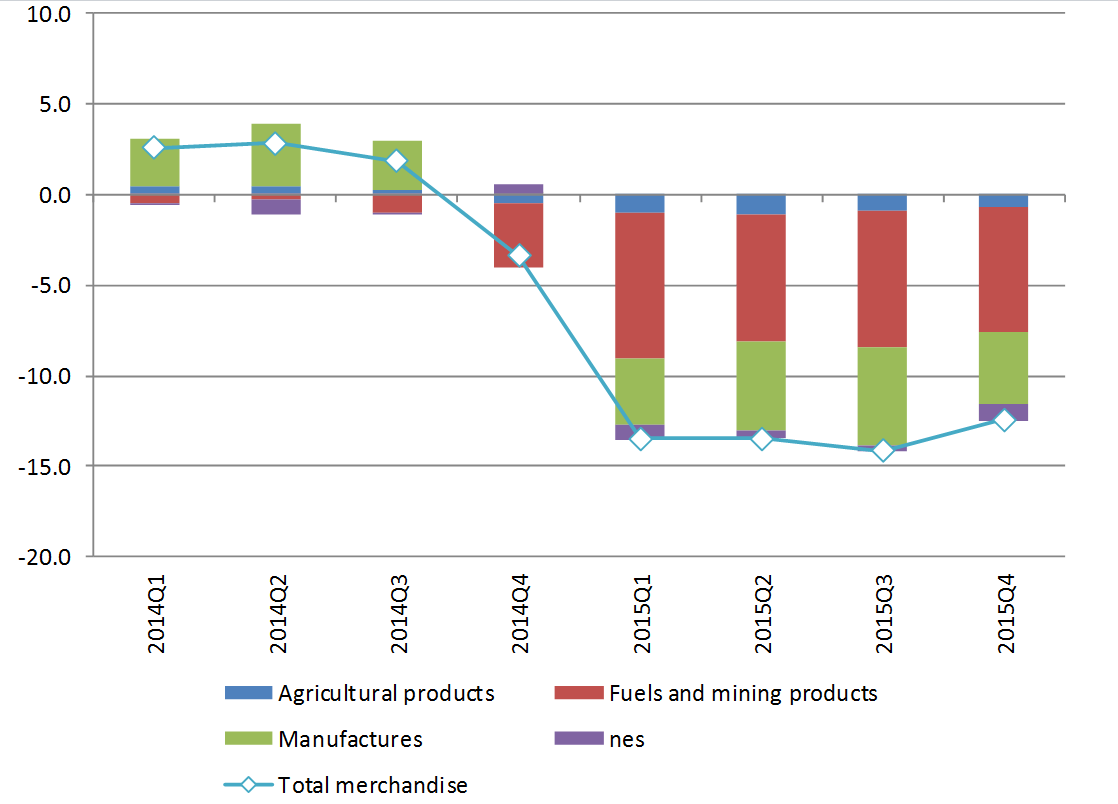

The WTO does not have a product breakdown of world trade growth in volume terms, but such a breakdown can be estimated for year-on-year growth in the dollar value of merchandise trade. This is shown for broad product groups in Chart 4, which illustrates that fuels and mining products were responsible for more than half of the drop in trade values in 2015, but that slowing trade in manufactures and agricultural products also contributed significantly to the overall decline. Among manufactured goods, the products where trade values notably declined in 2015 were office and telecom equipment, chemicals and other machinery (which includes investment goods and durables other than automobiles), while clothing and textiles only made a small contribution to growth.

The dollar value of intra-Asia imports of manufactured goods is estimated to have fallen around 5% in 2015, roughly in line with the decline of Asian imports of manufactured goods worldwide. This would seem to indicate a broad-based decline in trade values, perhaps more closely related to price fluctuations than to changes in production and consumption patterns. However, Asian imports of other machinery (a category that includes capital goods) registered a stronger decline of around 8%, suggesting a downturn in investment in the region. In particular, China's imports of other machinery from Europe and North America were down 15% and 8%, respectively, in 2015 based on Secretariat estimates. This falloff in investment may be temporary, driven by financial volatility, exchange rate uncertainty and unsettled monetary policy in 2015.

Chart 4: Contributions to year-on-year growth in world merchandise trade by product, 2014Q1-2015Q4

Year-on-year % change in current dollar values

Source: Secretariat estimates based on mirror data for available reporters in the Global Trade Atlas database.

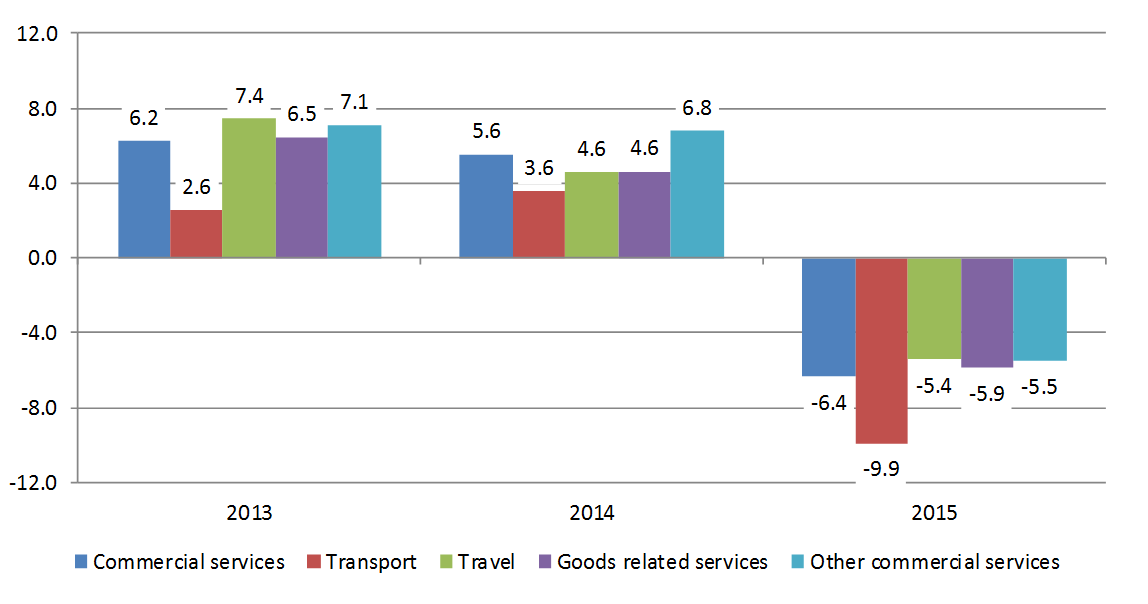

Chart 5 illustrates growth in the dollar value of world commercial services exports since 2013 broken down by major services categories. Commercial services trade recorded a 6.4% year-on-year decline in 2015, although transport services registered a larger drop of nearly 10% as prices for sea shipment of dry bulk cargo fell to record lows last year. Other types of services exports, such as travel and other commercial services (a category that include financial services) saw smaller declines of around 5.5%.

Chart 5: Growth in the value of commercial services exports by category, 2013-15

% change in US$ values

Source: WTO Secretariat

The drop in world commercial services exports was less than the 13.5% slide in the dollar value of merchandise exports, which was strongly influenced by fluctuations in primary commodity prices (See Appendix Tables 1 to 6 and Appendix Chart 1 for detailed breakdowns of merchandise and commercial services trade by region and leading traders). According to statistics from the International Monetary Fund, primary commodity prices have fallen by more than 50% on average since January 2014, with drops of around 20% for food and beverages, 30% for metals, and 65% for energy (fuels).

There is no volume indicator for services trade akin to the WTO's merchandise trade volume indices, but physical measures of services trade such as passenger arrivals and container port throughput (Chart 6) point to a resumption of growth after a slowdown in the middle of 2015.

Chart 6: Container shipping trend throughput index, January 2007 — January 2016

Seasonally adjusted trend index, 2010=100

Source: Institute for Shipping Economic and Logistics

Outlook for 2016 and 2017

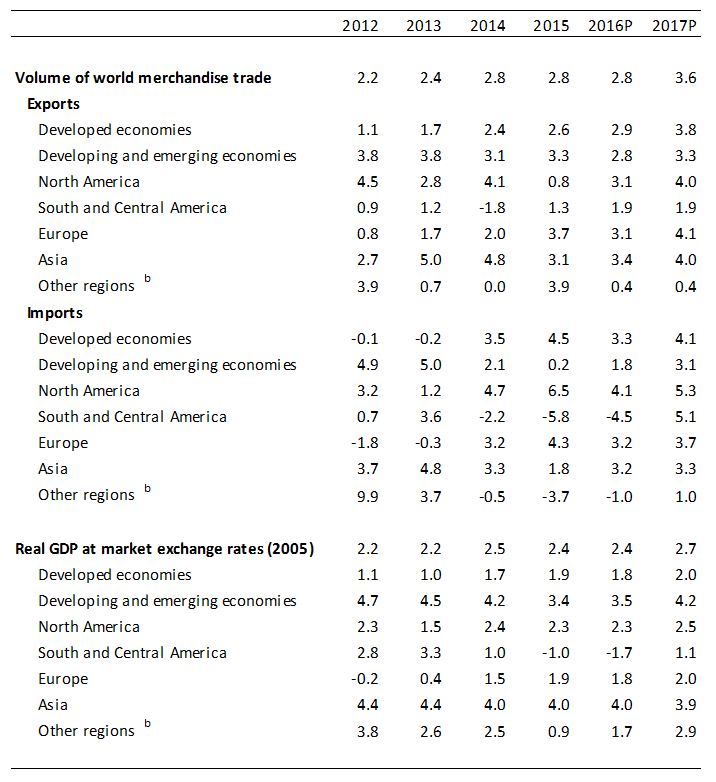

The WTO's forecast of 2.8% growth in the volume of world merchandise trade for 2016 and 3.6% trade growth for 2017 are based on consensus estimates of real GDP at market exchange rates from economic forecasters (Table 1). According to these estimates, world GDP should grow 2.4% this year and 2.7% next year, with growth slowing slightly in developed countries in 2016 and picking up modestly in developing ones.

Exports of developed and developing countries should grow at around the same rate in 2016, 2.9% in the former and 2.8% in the latter. Meanwhile, imports of developed economies are expected to outpace those of developing countries in 2016, with a 3.3% rise in the former compared to a 1.8% increase in the latter.

Asia is expected to record the fastest export growth of any region this year at 3.4%, followed by North America and Europe, each at 3.1%. South and Central America and Other regions will lag behind at 1.9% and 0.4%, respectively. North America should see its imports increase by 4.1% this year, while Asian and European imports should both register growth of 3.2%. Finally, imports of South and Central America and Other regions are set to contract again this year as oil and other commodity prices remain low, but the degree of contraction should be less.

Risks to the trade forecasts remain tilted to the downside. Business and consumer confidence has slipped recently in developed countries. As a result, forecasters now expect slower GDP growth in the European Union and the United States in 2016, followed by a rebound in 2017. Financial instability in Asia has mostly abated but could return if economic data come in above or below market expectations. On the other hand, more accommodative monetary policy from the European Central Bank could spur growth in the euro area and boost demand for goods and services, including imports.

Annual, quarterly and monthly trade data can be found at https://www.wto.org/english/res_e/statis_e/statis_e.htm

Table 1: Merchandise trade volume and real GDP, 2012-2017 a

Annual % change

a Figures for 2016 and 2017 are projections.

b Other regions comprise Africa, Commonwealth of Independent States and Middle East.

Sources: WTO Secretariat for trade, consensus estimates for GDP.

Appendix Tables and Charts

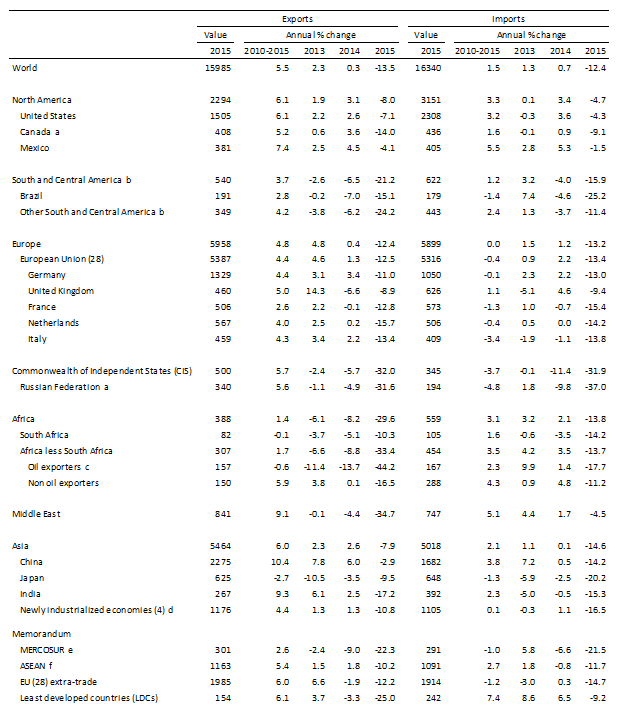

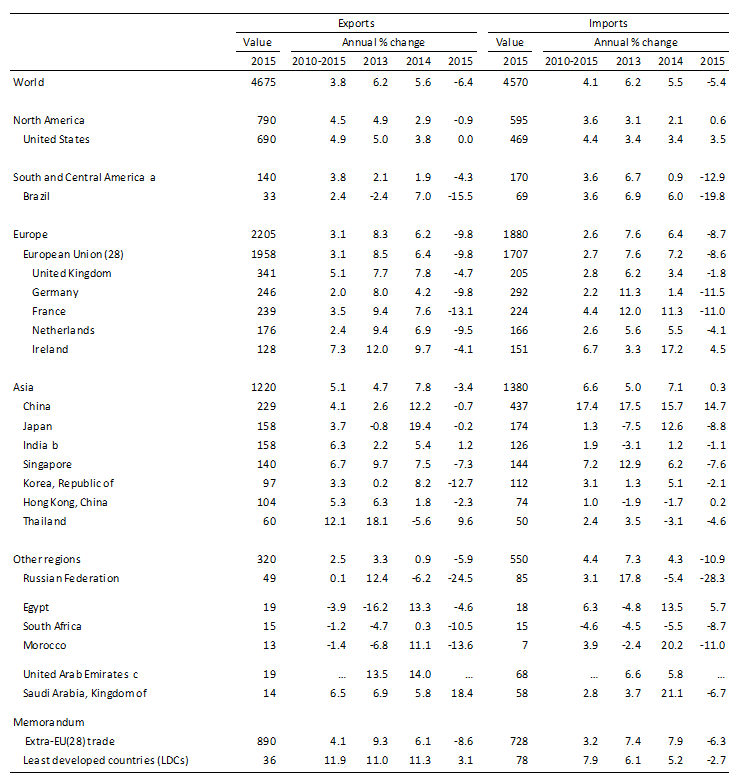

Appendix Table 1: World merchandise trade by region and selected economies, 2015

$bn and %

a Imports are valued f.o.b.

b Includes the Caribbean. For composition of groups see the Technical Notes of WTO, International Trade Statistics, 2015

c Algeria, Angola, Cameroon, Chad, Congo, Equatorial Guinea, Gabon, Libya, Nigeria, Sudan.

d Hong Kong, China; Republic of Korea; Singapore and Chinese Taipei.

e Southern Common Market: Argentina, Brazil, Paraguay, Uruguay and Venezuela, Bolivarian Rep. of

f Association of Southeast Asian Nations: Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand, Viet Nam.

Source: WTO Secretariat.

Appendix Table 2: World commercial services trade by region and selected economies, 2015

$bn and %

a Includes the Caribbean. For composition of groups see Chapter IV Metadata of WTO International Trade Statistics, 2015.

b Imports adjusted to f.o.b. valuation.

c Secretariat estimates. Quarterly data not available.

… indicates unavailable or non-comparable figures.

Note: Preliminary estimates based on quarterly statistics. While provisional data for Q1-Q4 2015 data were available in mid-March for some 80 countries (accounting for at least 80% of world commercial services trade), estimates for most other countries are based data for the first three quarters. More data available at https://www.wto.org/english/res_e/statis_e/short_tterm_stats_e.htm

Source: WTO and UNCTAD Secretariats

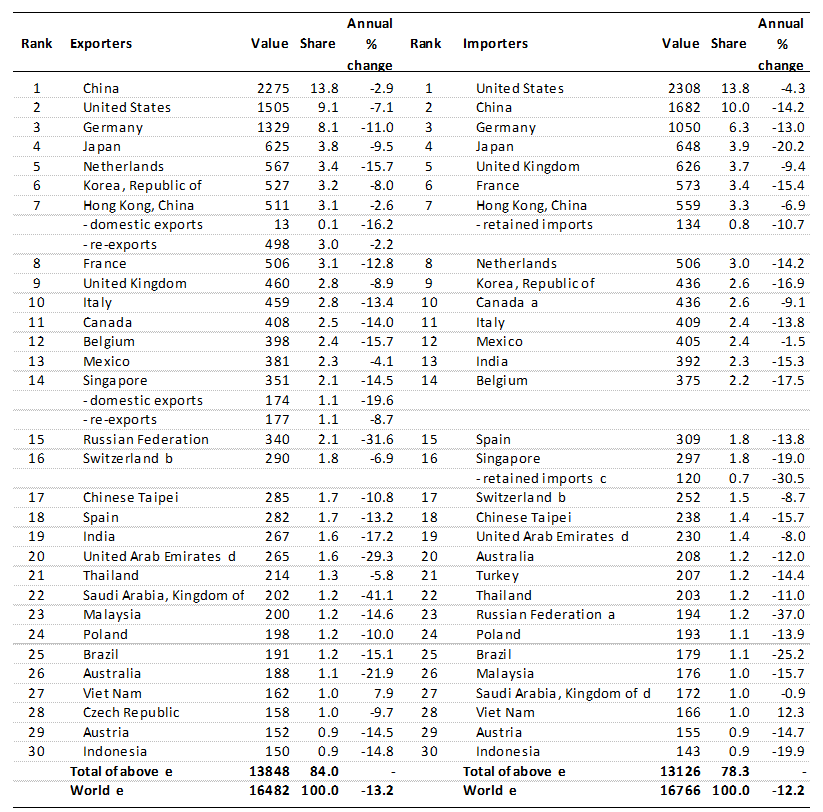

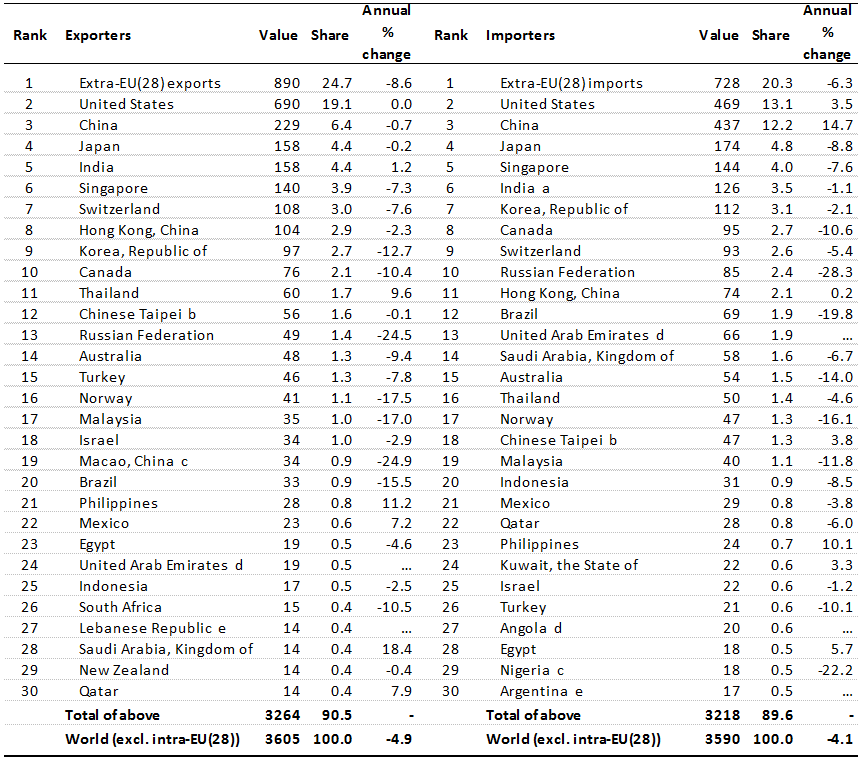

Appendix Table 3: Leading exporters and importers of merchandise trade, 2015

$bn and %

a Importers are valued f.o.b.

b Includes gold.

c Singapore's retained imports are defined as imports less re-exports.

d Secretariat estimates.

e Includes significant re-exports or imports for re-export.

Source: WTO Secretariat

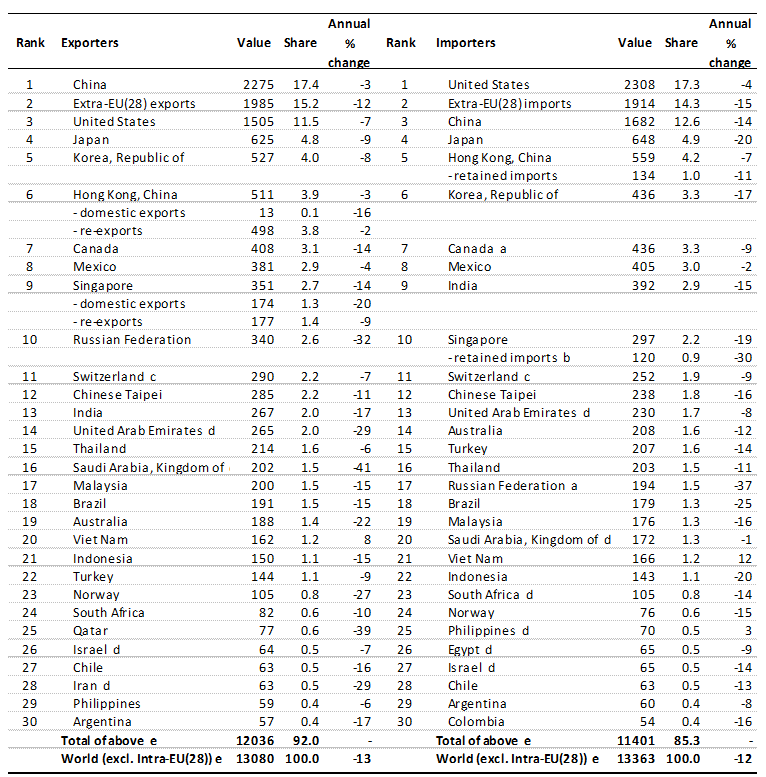

Appendix Table 4: Leading exporters and importers of merchandise trade exluding intra-EU (28) trade, 2015

$bn and %

a Imports are valued f.o.b.

b Singapore’s retained imports are defined as imports less re-exports.

c Includes gold.

d Secretariat estimates.

e Includes significant re-exports or imports for re-export.

Source: WTO Secretariat

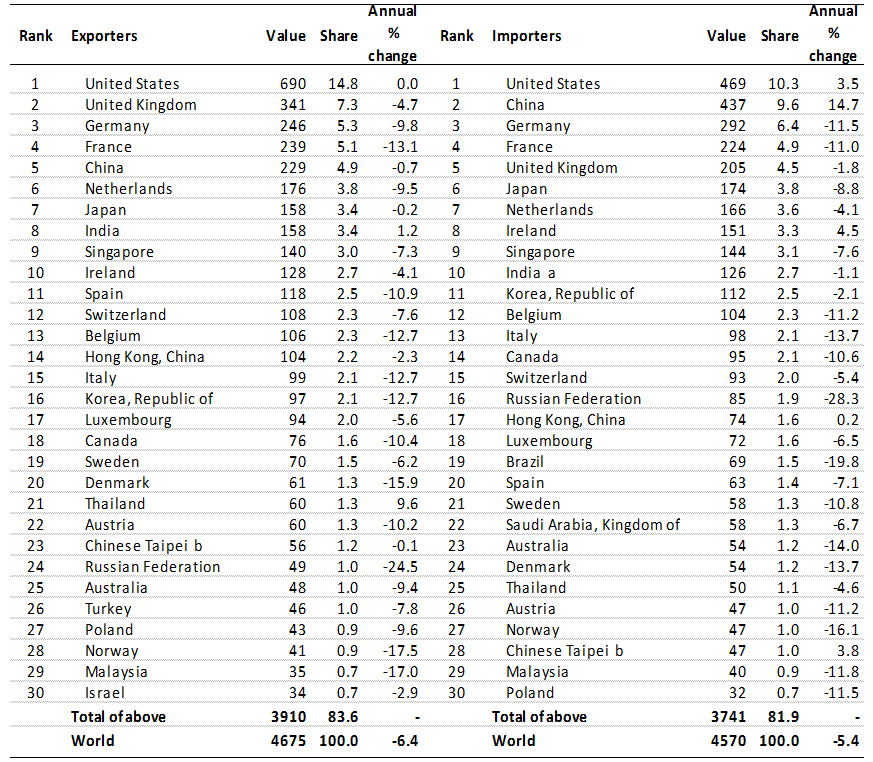

Appendix Table 5: Leading exporters and importers of commercial services, 2015

$bn and %

a Imports ajusted to f.o.b valuation.

b Data converted to BPM6 methodology. Manufacturing services on inputs owned by others are not covered.

… indicates unavailable or non-comparable figures.

- indicates non-applicable.

Note: Preliminary estimates based on quarterly statistics. Figures for a number of countries and territories have been estimated by the Secretariat.

More data available at https://www.wto.org/english/res_e/statis_e/short_term_stats_e.htm.

Source: WTO and UNCTAD Secretariat

Appendix Table 6: Leading exporters and importers of commercial services excluding intra EU(28) trade, 2015

$bn and %

a Imports ajusted to f.o.b valuation.

b Data converted to BPM6 methodology. Manufacturing services on inputs owned by others are not covered.

c Follows BPM5 services classification.

d Secretariat estimates. Quarterly data not available.

e Secretariat estimates.

… indicates unavailable or non-comparable figures.

- indicates non-applicable.

Note: Preliminary estimates based on quarterly statistics. Figures for a number of countries and territories have been estimated by the Secretariat.

More data available at https://www.wto.org/english/res_e/statis_e/short_term_stats_e.htm.

Source: WTO and UNCTAD Secretariat

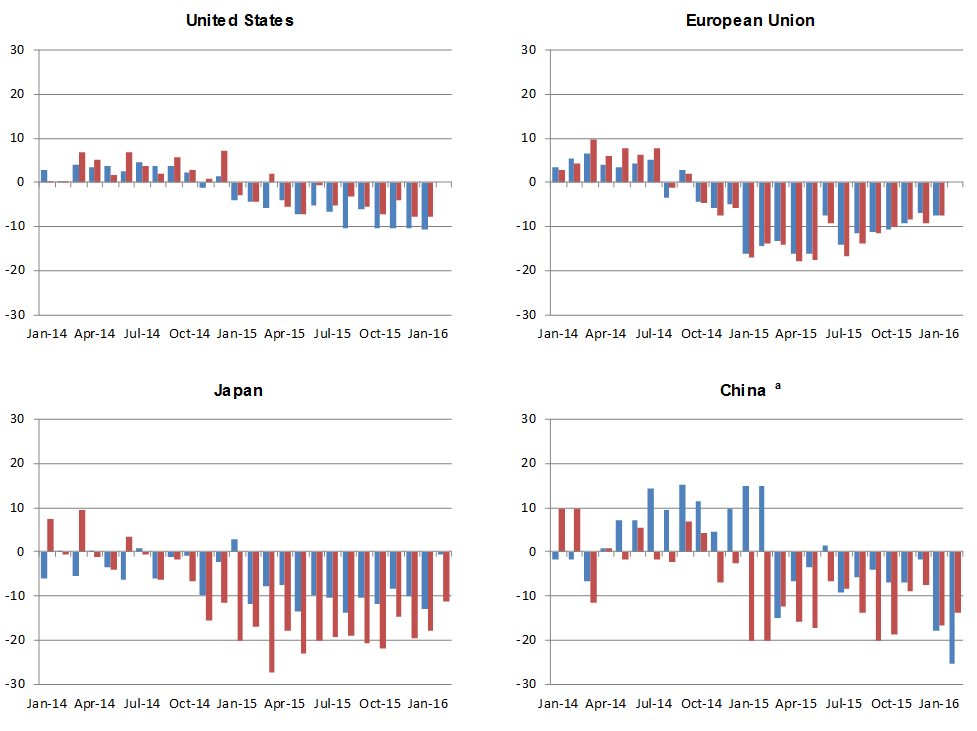

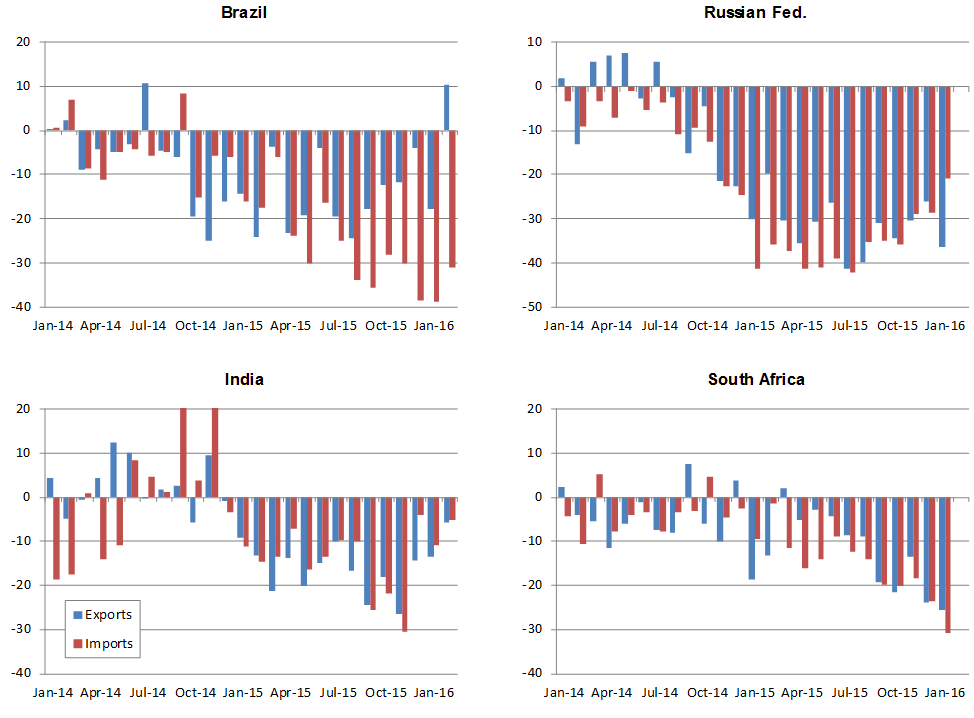

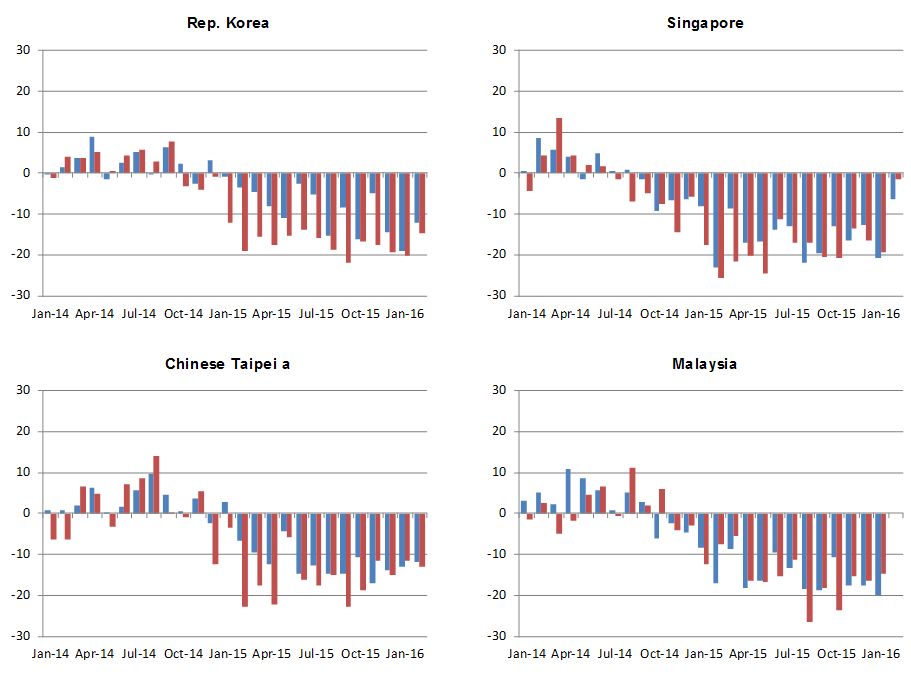

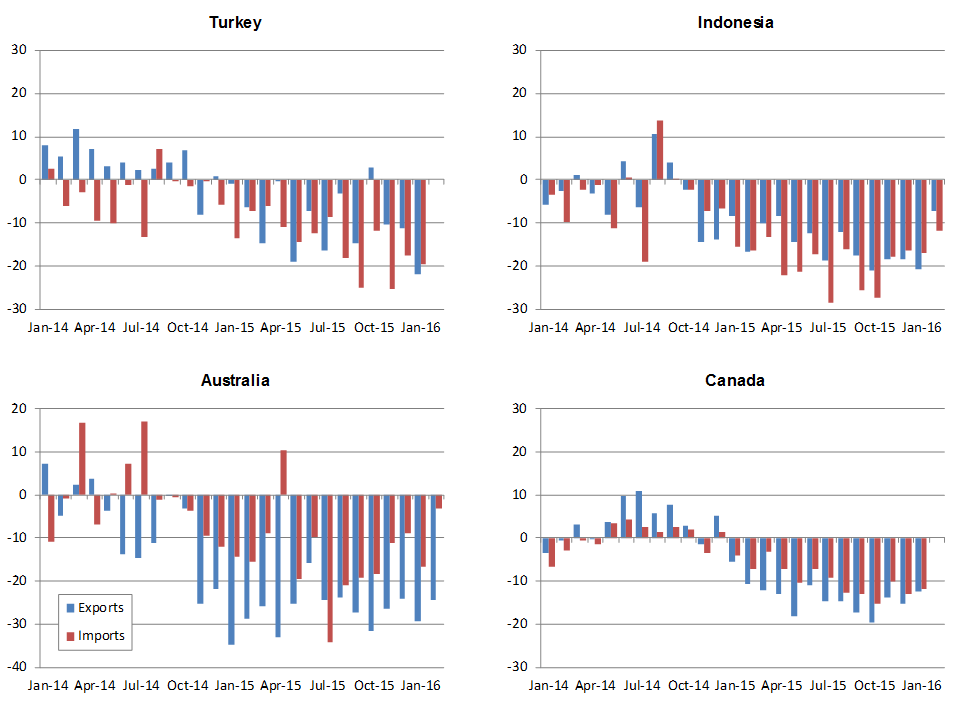

Appendix chart 1: Merchandise exports and imports of selected economies, July 2013-February 2016

(Year-on-year percentage change in current dollar values)

a January and February averaged to minimize distortions due to lunar new year.

Source: IMF International Financial Statistics. Global Trade Information Services GTA database, national statistics

> Download this press release (pdf format, 18 pages, 285KB)

> WTO trade forecasts press conference: Remarks by Director-General Roberto Azevêdo

> Problems viewing this page?

Please contact [email protected] giving details of the operating system and web browser you are using.