1. What is the ITA?

The original Information Technology Agreement (ITA) was reached on 13 December 1996, through a “Ministerial Declaration on Trade in Information Technology Products”, at the first WTO Ministerial Conference, held in Singapore.

As the first and most significant tariff liberalization arrangement negotiated in the WTO after its establishment in 1995, it led to the elimination of import duties on products which in 2013 accounted for an estimated US$ 1.6 trillion, almost three times as much as when it was signed in 1996. The IT sector has been one of the fastest growing sectors in world trade. Today, trade in these products accounts for approximately 10 per cent of global merchandise exports.

The ITA covers a large number of high technology products, including computers, telecommunication equipment, semiconductors, semiconductor manufacturing and testing equipment, software, scientific instruments, as well as most of the parts and accessories of these products.

Subscribed initially by 29 members, participation quickly increased at the beginning of 1997 when a number of other members decided to join the Agreement.

Today, following the recent accession of the Republic of Seychelles, the ITA now covers 81 WTO members, which account for approximately 97 per cent of world trade in information technology products.

The ITA requires each participant to eliminate and bind customs duties at zero for all products specified in the Agreement.

Because the ITA concessions are included in the participants' WTO schedules of concessions, the tariff elimination is implemented on a most-favoured nation (MFN) basis. This means that even countries that have not joined the ITA can benefit from the trade opportunities generated by ITA tariff elimination.

2. ITA product expansion negotiations

In May 2012, on the occasion of the 15th anniversary of the ITA, it was recognized that new categories of IT products had been developed, including a number of products which do not fall within the scope of the existing ITA. In light of new technological developments, some WTO members considered that the current product coverage of the ITA should be expanded.

In June 2012, 33 WTO members initiated an informal process towards launching negotiations for the expansion of the product coverage of the ITA. This process led to the establishment of a technical working group which met informally in Geneva, outside of the formal framework of the WTO ITA Committee. Participation in the ITA product expansion negotiations quickly increased to 54 WTO members.

After 17 rounds of negotiations, on Saturday, 18 July 2015, negotiators edged close to an agreement on a list of products for an ITA expansion, together with a draft declaration which spells out how the agreement would be implemented.

At a meeting on 24 July 2015, nearly all the participants agreed to expand the products covered by the Information Technology Agreement by eliminating tariffs on an additional list of 201 products. Annual trade in these 201 products is valued at over $1.3 trillion per year, and accounts for approximately 7% of total global trade today. The new accord covers new generation semi-conductors, semi-conductor manufacturing equipment, optical lenses, GPS navigation equipment, and medical equipment such as magnetic resonance imaging products and ultra-sonic scanning apparatus.

3. Who is participating in the expansion of the ITA?

Fifty-four WTO members took part in the negotiations on expanded coverage of the ITA. Nearly all the participants have confirmed their acceptance of the product coverage list, which was finalized on 24 July. Together, they account for approximately 90 per cent of world trade in the products proposed for inclusion in the product expansion. The Agreement is open to any other members who wish to join.

4. What is the current level of MFN applied tariffs for the products under the ITA expansion?

Import duties on some of the covered products are relatively high in some markets. In the United States, for instance, applied duties on certain parts of telephone handsets are at 8.5%, while in China 35% duties are applied on video cameras, the EU tariff applied on DVD recorders is 14% and Thailand applies a duty of 30% on certain magnetic cards.

Beyond the monetary gains for the IT industry resulting from the elimination of import duties, investors and traders would also gain from significantly improved market access, predictability and certainty. This is because a number of these products are either currently unbound (i.e. they are not subject to a legal maximum limit at the WTO) or are bound at high tariff levels. With the ITA product expansion, the participating members would have the legal obligation not to impose import duties on covered products.

5. What happens next?

Under the terms of the agreement, the majority of tariffs will be eliminated on the 201 products within three years, with reductions beginning in 2016. By the end of October 2015, each of the participating members will submit to the other participants a draft schedule which spells out how the terms of the agreement would be met. Participants will spend the coming months preparing and verifying these schedules. The objective is to conclude this technical work in time for the Nairobi Ministerial Conference in December.

The agreement also contains a commitment to tackle non-tariff barriers in the IT sector, and to keep the list of products covered under review to determine whether further expansion may be needed to reflect future technological developments.

Annex I

Data on ITA expansion

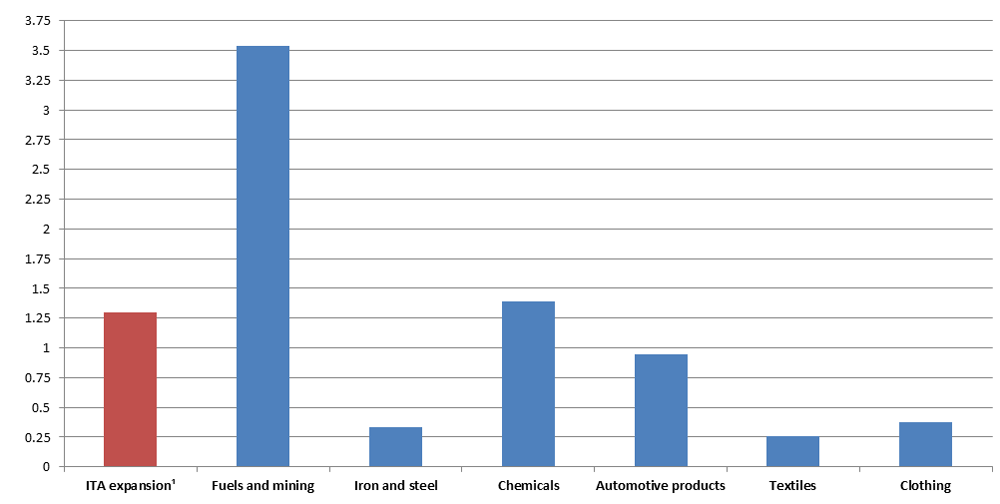

Chart 1 ITA Expansion: World exports of selected product groups, 2013 $tn

¹ Exports by participants in the ITA expansion negotiations.

Excluding EU-intra trade and excluding re-exports of Hong Kong, China.

Source: UN Comtrade (ITA expansion; avail. reporters), WTO Secretariat (all other product groups)

Chart 2 ITA Expansion: Estimated value of trade covered by the agreement, by member,

2011-2013

| member | Exports: 2011-13 average $bn | Imports: 2011-13 average $bn |

| Albania | 0.0 | 0.2 |

| Australia | 3.6 | 18.9 |

| Canada | 16.3 | 34.5 |

| China | 300.4 | 372.6 |

| Colombia* | 0.2 | 3.7 |

| Costa Rica | 2.7 | 2.5 |

| European Union (28) | 196.7 | 178.8 |

| Guatemala | 0.1 | 0.7 |

| Iceland | 0.1 | 0.2 |

| Israel | 10.4 | 7.1 |

| Hong Kong, China | 0.9 | 19.2 |

| Japan | 139.7 | 79.1 |

| Korea | 95.5 | 67.3 |

| Malaysia | 45.6 | 41.0 |

| Mauritius* | 0.0 | 0.2 |

| Montenegro | 0.0 | 0.1 |

| New Zealand | 0.7 | 2.7 |

| Norway | 3.4 | 6.2 |

| Philippines | 4.7 | 6.9 |

| Singapore | 120.9 | 85.0 |

| Switzerland | 19.0 | 13.6 |

| Chinese Taipei | 95.1 | 62.8 |

| Thailand | 23.0 | 26.7 |

| Turkey* | 1.9 | 10.8 |

| United States | 178.9 | 212.0 |

| Rest of the world | 74.0 | 228.7 |

1) excluding EU-intra trade and re-exports of Hong Kong, China.

*Participation in the expanded ITA to be confirmed

Source: WTO Secretariat (based on data from UN Comtrade).

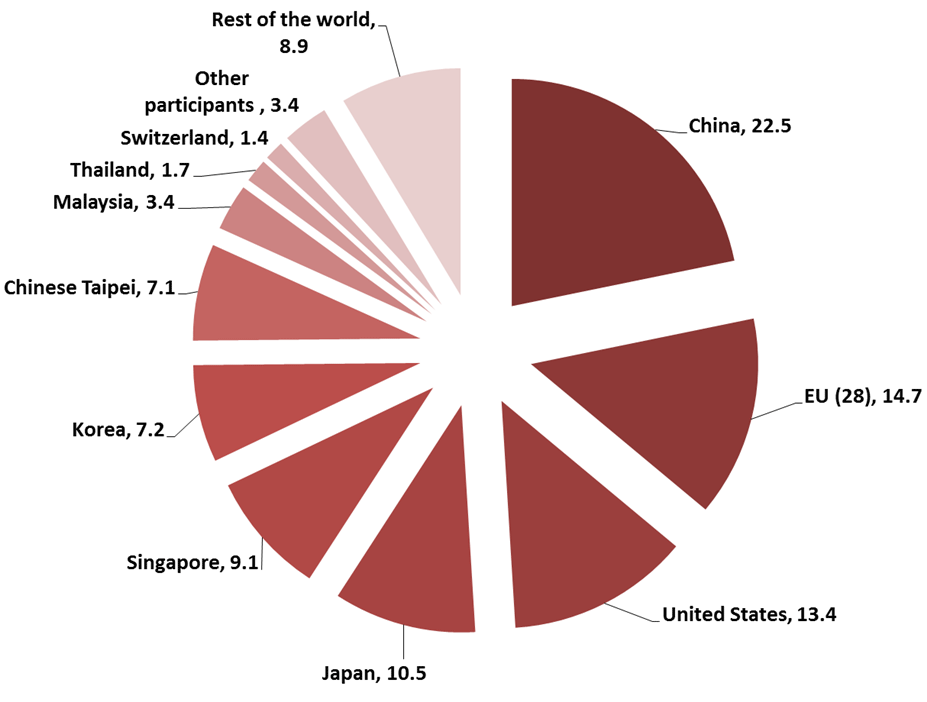

Chart 3 ITA Expansion: Share of exports of products covered by the agreement,

by member, 2011-2013 (%)

1) excluding EU-intra trade and re-exports of Hong Kong, China.

1) excluding EU-intra trade and re-exports of Hong Kong, China.

Source: WTO Secretariat (based on data from UN Comtrade).

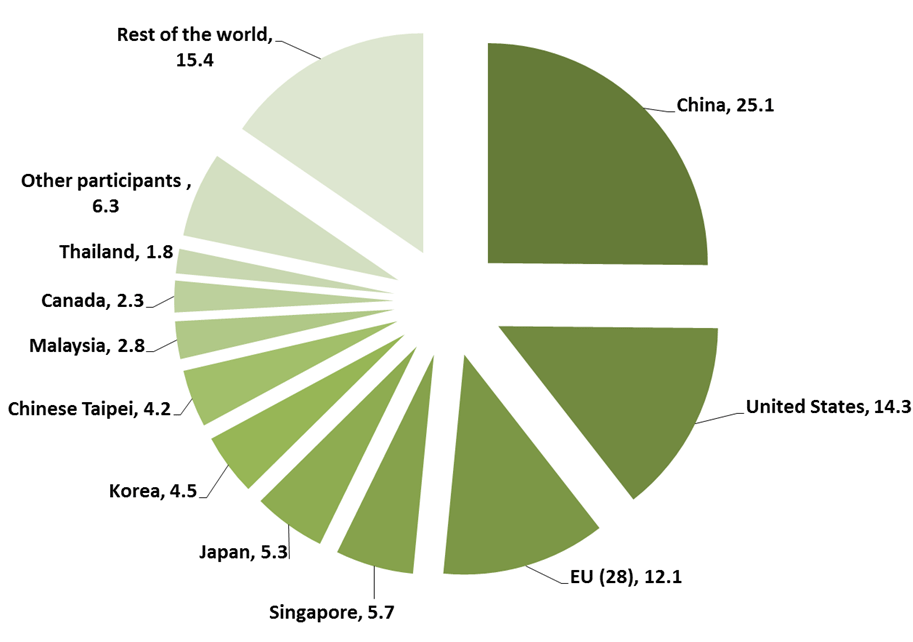

Chart 4 ITA Expansion: Share of imports of products covered by the agreement,

by member, 2011-2013 (%)

1) excluding EU-intra trade and re-exports of Hong Kong, China.

1) excluding EU-intra trade and re-exports of Hong Kong, China.

Source: WTO Secretariat (based on data from UN Comtrade).

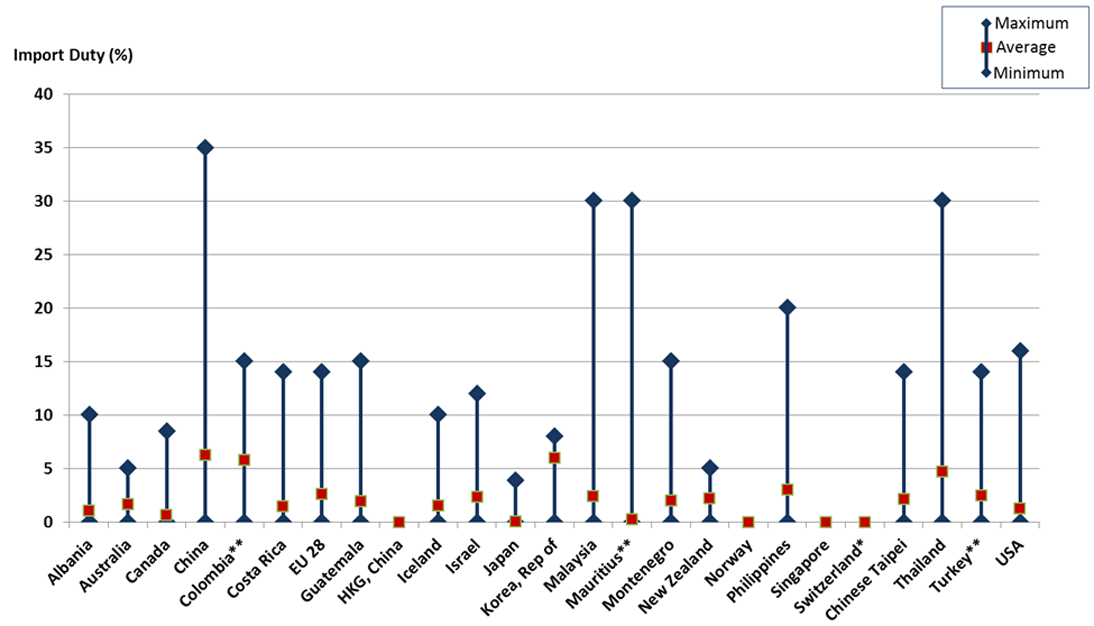

Chart 5 ITA Expansion: Applied MFN duty on products covered by the agreement

* 74% of Switzerland's tariff lines have non-ad valorem duty.

**Participation in the expanded ITA to be confirmed

Note: Based on HS 6 digits. The maximum and averages above may overestimate the duties levied on products covered by the ITA Expansion

Source: WTO Secretariat based on the Integrated Database