One year of war in Ukraine. What has been the impact on global trade?

Over the past year, the war in Ukraine has caused immense human suffering. It has also had major economic repercussions, especially on trade. However, trade has performed a lot better than first feared, with many economies most affected by the conflict finding alternative sources of supply.

A WTO Secretariat note issued today assesses the impact of the war on international trade. It has two main messages:

- First, international trade proved to be highly resilient, thereby helping countries adjust to the economic effects of the war.

- Second, the WTO played an important role in enabling this resilience, and there are benefits to be reaped from further strengthening the WTO.

Macroeconomic effects

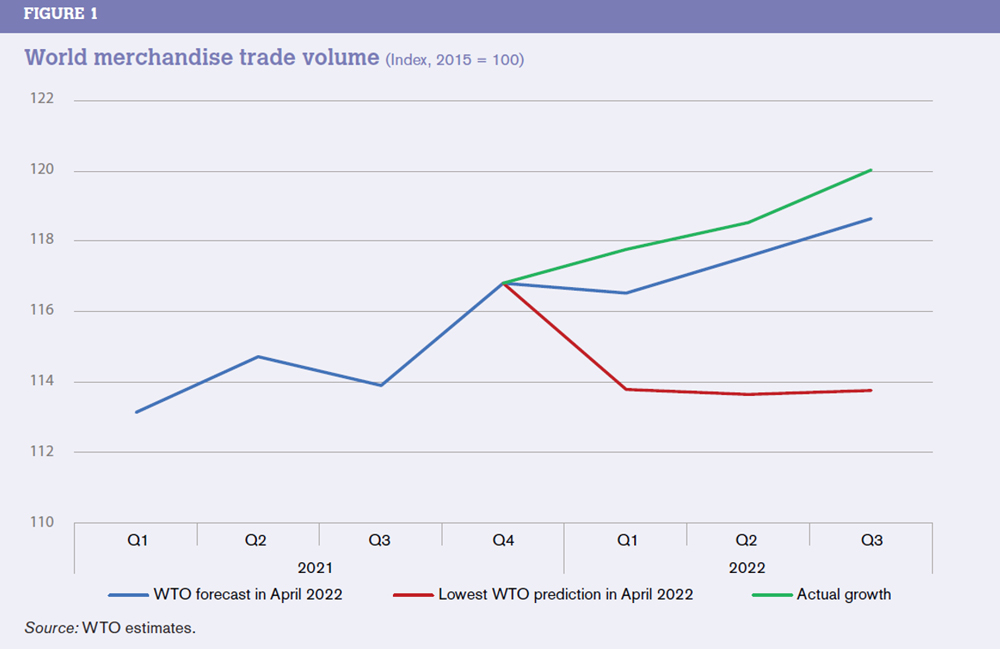

The war has reduced trade growth, but by much less than we initially feared. In October 2021, the WTO forecast that goods trade would grow by 4.7 per cent in 2022.

At the onset of the war, we sharply adjusted this forecast downward to between 2.4 and 3.0 per cent, with pessimistic scenarios going as low as 0.5 per cent.

In October 2022, we again revised our forecast upward to 3.5 percent, given that actual trade growth exceeded our earlier estimates, proving the resilience of world trade over the past year.

Impact on Russian and Ukrainian exports

Ukraine's exports decreased by 30 per cent from 2021 to 2022, with exports falling across the board. However, some neighbouring countries, such as Poland and Hungary, actually increased their sourcing from Ukraine, in particular for agricultural products.

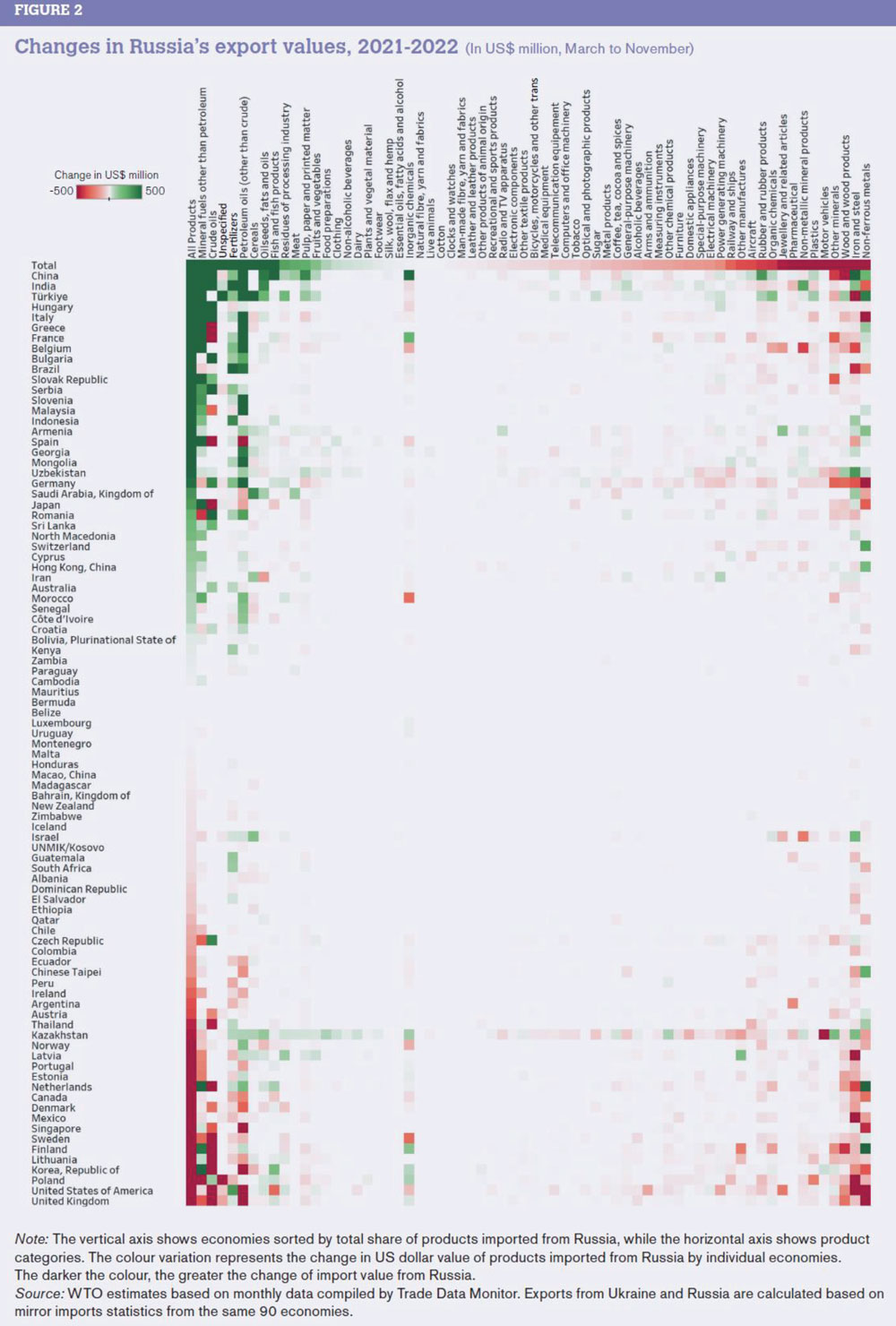

Russia's exports increased by 15.6 per cent during the same time period. This was mostly driven by an increase in prices, particularly for fuels, fertilizers and cereals. However, export volume may have declined slightly.

The biggest increase in Russian exports was to China and India, while the largest decrease was in exports to the United Kingdom and the United States. The biggest decline was in complex industrial goods, such as motor vehicles and pharmaceuticals, as well as non-complex industrial goods, such as wood products and steel.

Impact on countries highly dependent on Russia and Ukraine

One of the key concerns at the onset of the war was that there could be shortages in products where Russia and Ukraine have a significant market share. There were particular concerns for wheat, maize, sunflower products, fertilizers, fuels and palladium.

Such shortages have been largely avoided. In particular, global trade volumes broadly remained at pre-war levels after initial slumps in products such as wheat. Prices for goods most affected by the war rose — contributing to inflation around the world — but by less than originally feared.

Countries particularly dependent on imports from Ukraine managed to find alternative sources of supply. For example, Egypt's imports of wheat from Ukraine plunged an estimated 81 per cent in volume terms in the first eight months of the war but it made up for this by importing from alternative suppliers, such as the European Union.

There was also substitution across products. For example, Türkiye responded to a decrease in wheat imports by sharply increasing its rice imports. This underlines the importance of the multilateral trading system provided by the WTO which allows trade to flow where it is needed most.

The role of trade policy

The lower-than-expected rise in food prices was in large part due to countries showing restraint in imposing export restrictions. The WTO supported this effort. For example, the Ministerial Declaration on the Emergency Response to Food Insecurity adopted at the 12th Ministerial Conference last June in Geneva committed WTO members to take concrete steps to keep trade open for food and agricultural products.

However, the WTO's Trade Monitoring Reports show an increase in export restrictions taken in the context of the war so it is important to stay vigilant.

Simulations on the longer-term outlook

Simulations by WTO economists highlight the importance of maintaining a strong multilateral trading system. We previously estimated that a decoupling of the world economy into a Western and Eastern bloc would lead to real income losses of 5.4 per cent on average. We now estimate the potential gains from a further reduction in tariffs and non-tariff measures would be 3.2 per cent on average, raising the opportunity cost of fragmentation into rival blocs to 8.7 per cent on average. The stakes are highest for least-developed economies, with opportunity costs reaching as much as 11.3 per cent on average.

Let me end by reminding you of the two main findings. First, international trade has proved to be highly resilient, helping countries adjust to the economic effects of the war. Second, the WTO has played an important role in enabling this resilience, and there are further benefits to be gained from strengthening the multilateral trading system.