TRADE MONITORING

More

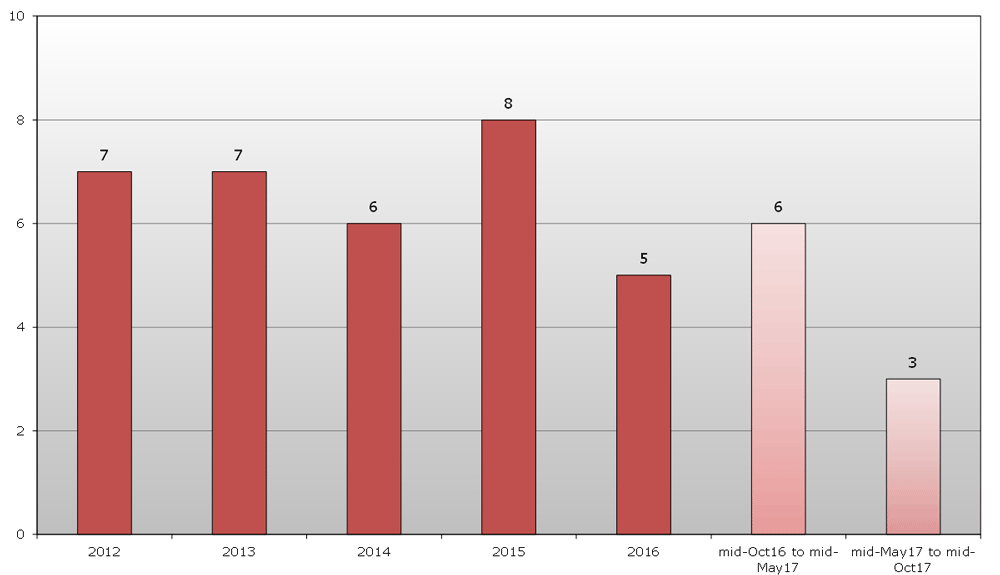

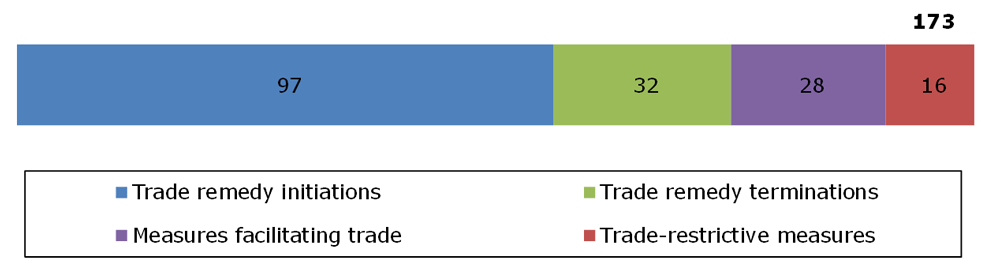

A total of 16 new trade-restrictive measures were adopted by G20 economies during the review period (mid-May 2017 to mid-October 2017), including new or increased tariffs, export restrictions and local content measures. This is an average of just over three restrictive measures per month compared to six during the previous review period (mid-October 2016 to mid-May 2017).

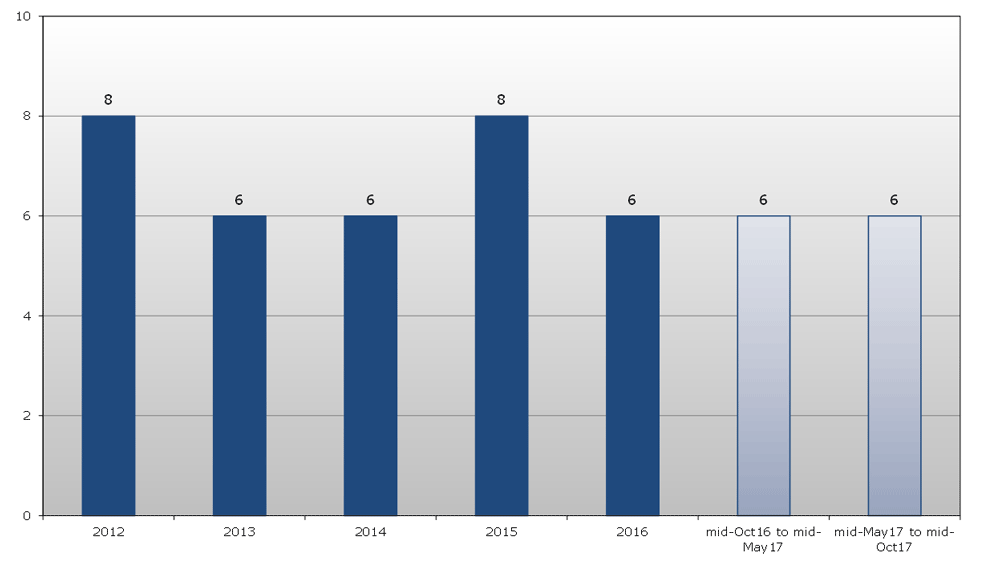

G20 economies also implemented 28 measures aimed at facilitating trade during the review period, including eliminated or reduced tariffs and simplified customs procedures. At an average of almost six trade-facilitating measures per month, this represents a similar level compared with the previous review period and for the whole of 2016.

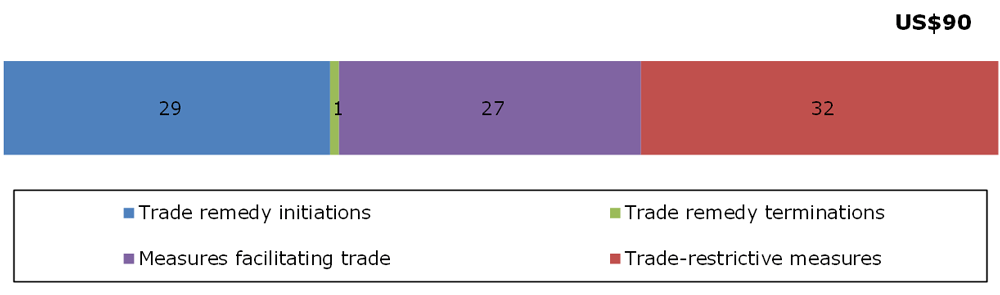

The estimated trade coverage of import-facilitating measures implemented by G20 economies (US$27 billion) is slightly lower than the estimated trade coverage of import-restrictive measures ($32 billion). This is a reversal from the previous report where the estimated trade coverage of import-facilitating measures was more than three times larger than that of import restrictive measures.

Commenting on the report, Director-General Roberto Azevêdo said:

“G20 members have shown restraint in implementing trade-restrictive measures, despite continuing economic uncertainties. This is positive news and it shows again that the global trading system is working. Nevertheless, the threat of protectionism remains and so I urge G20 countries to redouble their efforts to avoid implementing new trade restrictions and to reverse those measures that are currently in place.

“The G20's continued support for open and mutually beneficial trade is essential and I hope that we will see this leadership once more at 11th WTO Ministerial Conference in December. This meeting will be an important opportunity to continue improving the global trading environment. Our last two ministerial conferences have delivered major trade reforms such as the Trade Facilitation Agreement, the elimination of agricultural export subsidies, and the expansion of the Information Technology Agreement. Indeed, this report highlights the impact of this work, finding that the additional import-facilitating measures implemented in the context of the expanded Information Technology Agreement amounted to around US$300 billion.”

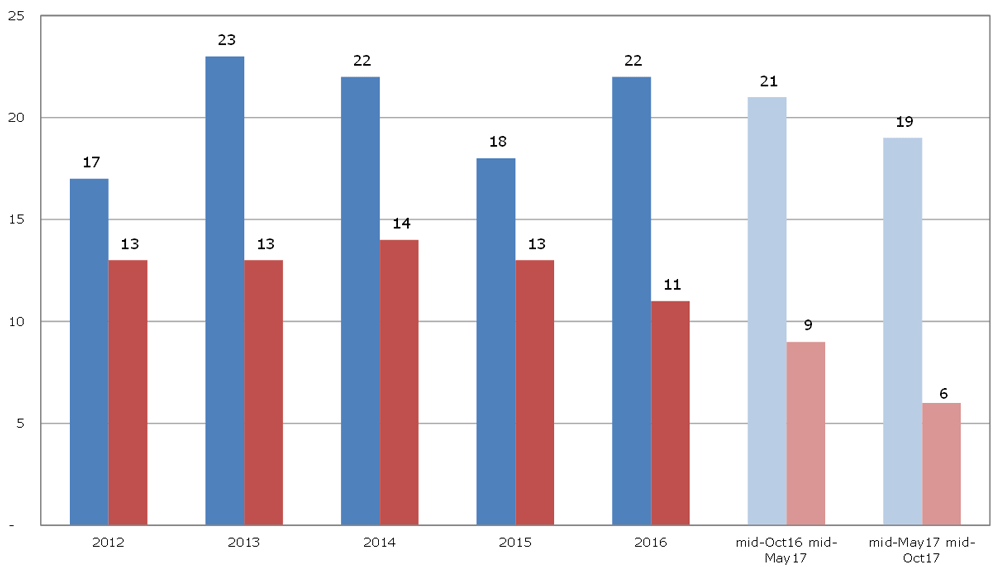

The initiation of trade remedy investigations in the review period represented more than 50% of trade measures recorded. However, the amount of trade covered by these is relatively small (US$29 billion for trade remedy initiations and US$1 billion for terminations). Initiations of trade remedy actions outpaced terminations by a ratio of three to one, marking the highest gap between initiations and terminations since 2012. The main sectors affected by trade remedy initiations during the review period were electrical machinery and parts thereof, organic chemicals and paper products. The main sectors where trade remedy duties were terminated were organic chemicals, iron and steel and man-made filaments.

The G20 economies are Argentina, Australia, Brazil, Canada, China, the European Union, France, Germany, India, Indonesia, Italy, Japan, Republic of Korea, Mexico, the Russian Federation, the Kingdom of Saudi Arabia, South Africa, Turkey, the United Kingdom and the United States.

Key Findings

- G20 economies applied 16 new trade-restrictive measures during the review period (mid May 2017 to mid-October 2017), including new or increased tariffs, export restrictions and local content measures. This equates to an average of just over three restrictive measures per month compared to six during the previous review period.

- G20 economies also implemented 28 measures aimed at facilitating trade over this review period, including eliminated or reduced tariffs and simplified customs procedures. At almost six trade-facilitating measures per month, this remains broadly equivalent to the previous period and to the trend observed for the whole of 2016.

- It is nevertheless worth noting that the trade coverage of trade facilitating measures during the review period (US$27 billion) is markedly lower than the previous period (US$163 billion). The coverage of trade-restrictive measures also fell during the review period, reaching US$32 billion, down from US$47 billion in the previous period.

- Therefore, despite the low number of trade restrictions recorded, their estimated trade coverage (US$32 billion) actually exceeded the estimated trade coverage of import facilitating measures by a slight amount (US$27 billion). This is a reversal of the findings of the previous report where the estimated trade coverage of import-facilitating measures was more than three times larger than that of import-restrictive measures.

- The import-facilitating measures implemented during the review period in the context of the ITA Expansion Agreement are estimated at around US$300 billion or 2.5% of the value of G20 merchandise imports.

- On trade remedy measures, the review period saw a moderate decline in initiations of investigations by G20 economies and a significant decline of terminations, compared to the previous review period and to the whole of 2016. Initiations of trade remedy actions outpaced terminations by a ratio of three to one, marking the highest gap between initiations and terminations since 2012. Initiations of trade remedy investigations represent over 50% of all trade measures recorded during the review period.

- Transparency and predictability in trade policy remains vital for all actors in the global economy. The G20 should show leadership in reiterating their commitment to open and mutually beneficial trade as a key driver of economic growth and a major engine for prosperity.

- Faced with continuing global economic uncertainties, the G20 should seek to continue improving the global trading environment and including through working together to achieve a successful outcome at the 11th WTO Ministerial Conference in December.

G20 Trade-restrictive measures

(average per month)

Note: Values are rounded. Changes to averages of previous years reflect continuing fine‑tuning and updates of the TMDB.

Note: Values are rounded. Changes to averages of previous years reflect continuing fine‑tuning and updates of the TMDB.Source: WTO Secretariat.

G20 Trade-facilitating measures

(average per month)

Note: Values are rounded. Changes to averages of previous years reflect continuing fine‑tuning and updates of the TMDB.

Note: Values are rounded. Changes to averages of previous years reflect continuing fine‑tuning and updates of the TMDB.

Source: WTO Secretariat.

G20 Trade remedy initiations and terminations

Source: WTO Secretariat.

Source: WTO Secretariat.

G20 measures, mid-May 2017 to mid-October 2017

(by number)

Source: WTO Secretariat.

Source: WTO Secretariat.

Trade coverage of G20 measures, mid-May 2017 to mid-October 2017

(US$ billions)

Source: WTO Secretariat.

Source: WTO Secretariat.

Share

Share

Problems viewing this page? If so, please contact [email protected] giving details of the operating system and web browser you are using.