TRADE MONITORING

More

Commenting on the report, Director-General Roberto Azevêdo said:

“This report provides further evidence that the turbulence generated by current trade tensions is continuing, with trade flows being hit by new trade restrictions on a historically high level. The stable trend that we saw for almost a decade since the financial crisis has been replaced with a steep increase in the size and scale of trade-restrictive measures over the last year. This will have consequences in increased uncertainty, lower investment and weaker trade growth.

“These findings should be of serious concern for the whole international community. We urgently need to see leadership from the G20 to ease trade tensions and follow through on their commitment to trade and to the rules-based international trading system.”

The Report shows that turbulence in global trade continued during the period. The previous period saw a record level of new restrictive measures introduced. Most of these measures remain in place and have now been added to by a series of new measures in the current period which are also of a historically high level. In addition, several significant trade-restrictive measures are being considered for potential later implementation. This further compounds the challenges and uncertainty faced by governments, businesses and consumers in the current global economic environment.

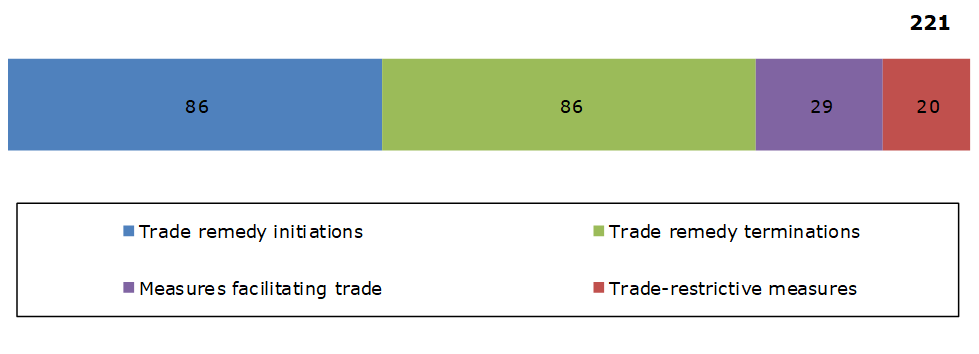

In terms of numbers, G20 economies implemented 20 new trade-restrictive measures between mid-October 2018 and mid-May 2019, including tariff increases, import bans and new customs procedures for exports. While fewer measures were introduced during this review period than in previous periods, the scale of those measures is much increased in terms of their trade coverage and the level of tariffs imposed.

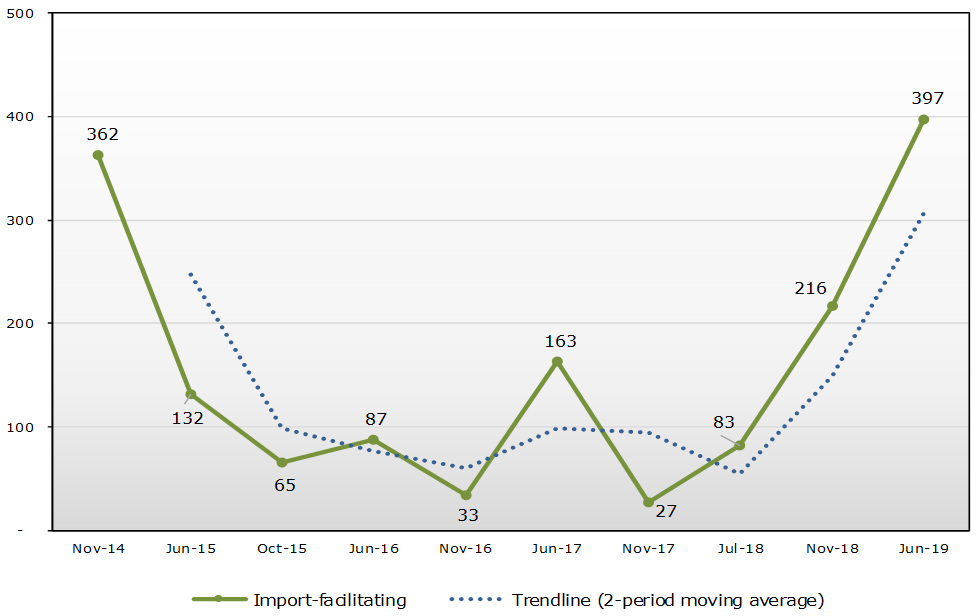

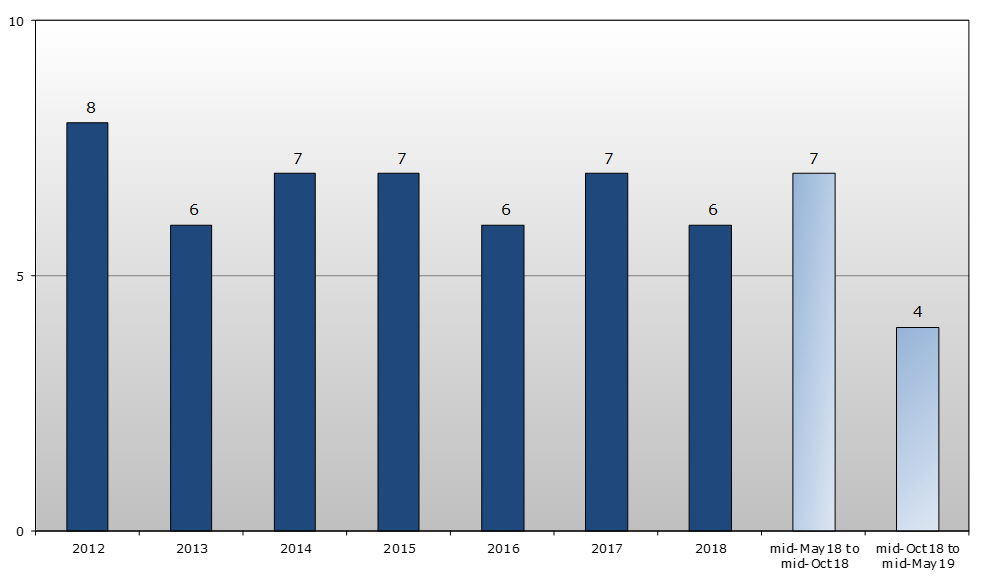

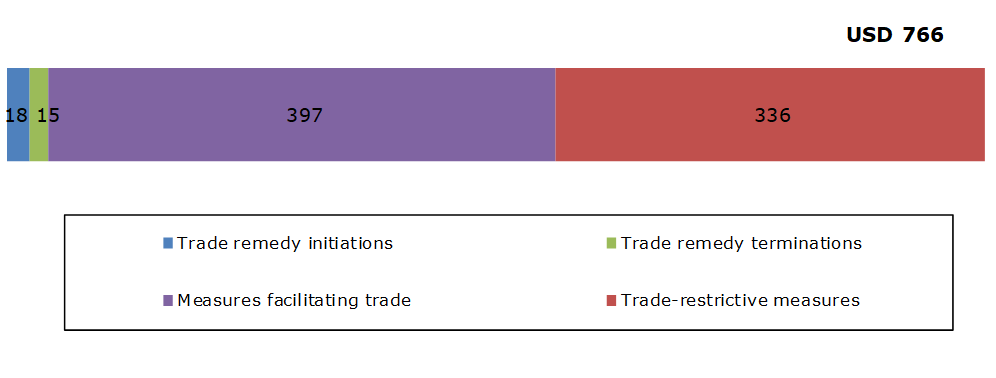

A total of 29 new measures aimed at facilitating trade, including eliminating or reducing import tariffs, export duties and eliminating or simplifying customs procedures for exports were also applied by G20 economies. The trade coverage of the import-facilitating measures implemented during the review period is estimated at USD 397.2 billion, which is 1.8 times higher than in the previous G20 Report. At four new trade-facilitating measures per month, this is the lowest monthly average registered since 2012.

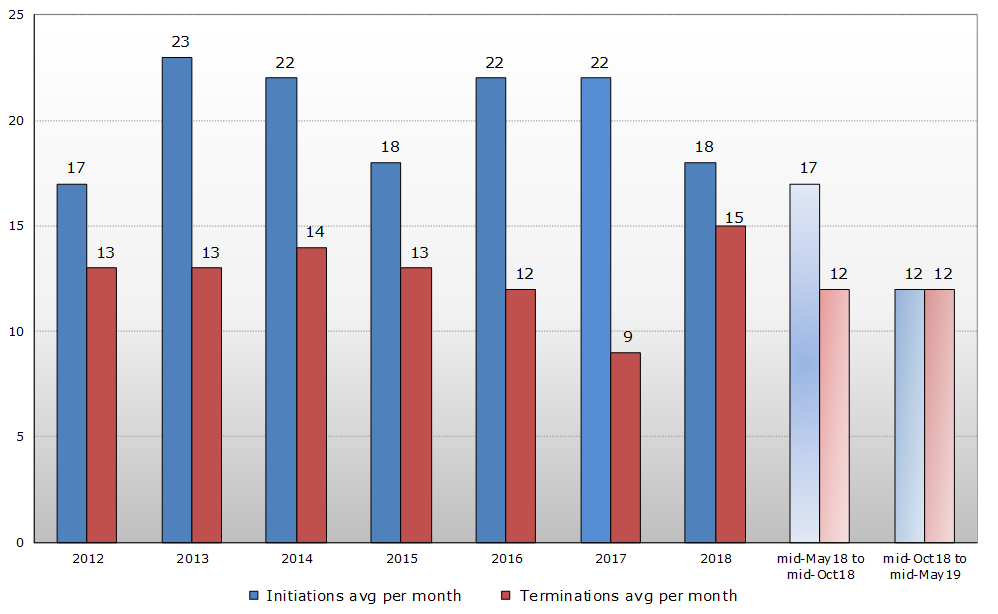

For the first time since the beginning of the trade monitoring exercise, the number of initiations of trade remedy investigations by G20 economies is equal to the number of trade remedy actions terminated. Initiations of anti-dumping investigations continue to be the most frequent trade remedy action, accounting for more than three-quarters of all initiations.

The WTO trade monitoring reports have been prepared by the WTO Secretariat since 2009. G20 members are: Argentina; Australia; Brazil; Canada; China; the European Union; France; Germany; India; Indonesia; Italy; Japan; the Republic of Korea; Mexico; the Russian Federation; Saudi Arabia; South Africa; Turkey; the United Kingdom; and the United States.

Key findings

- This Report covers new trade and trade-related measures implemented by G20 economies between 16 October 2018 and 15 May 2019. During this period trade tensions continued to dominate the headlines and added to the uncertainty surrounding international trade and the world economy.

- The Report provides evidence that this turbulence is continuing. The previous period saw a record level of new restrictive measures introduced. Most of these measures remain in place and have now been added to by a series of new measures in the current period which are also of a historically high level.

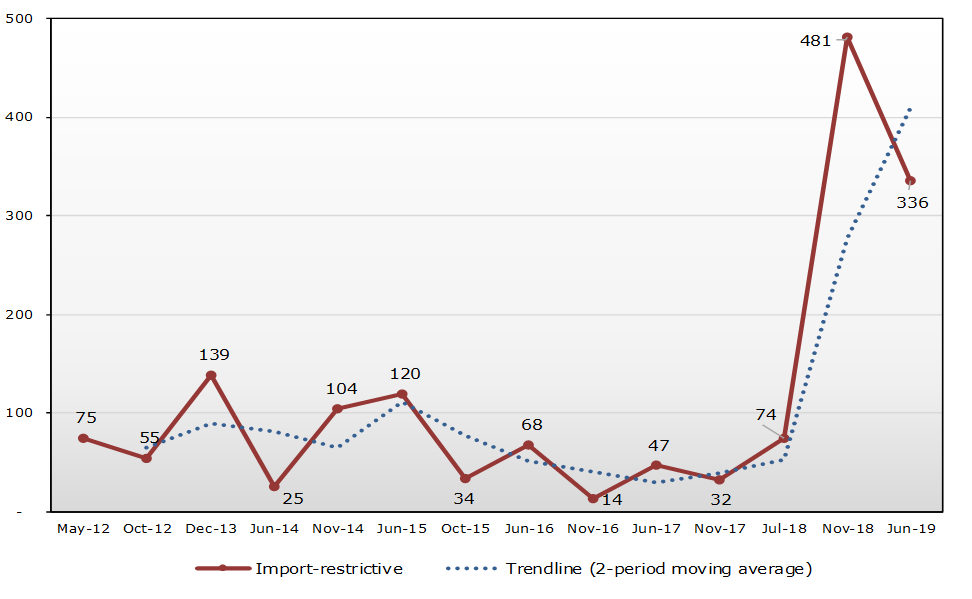

- The trade coverage of new import-restrictive measures introduced by G20 economies during this period was more than three-and-a-half times the average since May 2012 when the Report started including trade coverage figures.

- The trade coverage of import-restrictive measures during the period is estimated at USD 335.9 billion. This is the second highest figure on record, after the USD 480.9 billion reported in the previous period. Together these two periods represent a dramatic spike in the trade coverage of import-restrictive measures. The stable trend identified up to July 2018 has been replaced with a steep increase in the trade coverage of import-restrictive measures.

- The Report also notes that several significant trade-restrictive measures which fall outside of the review period remain under consultation for potential later implementation. This further compounds the challenges faced by governments, businesses and consumers in the current global economic environment.

- In terms of the number of measures introduced, G20 economies implemented 20 new trade-restrictive measures during the period, including tariff increases, import bans and new customs procedures for exports. While fewer measures were introduced during this review period than in previous periods, the scale of those measures is much increased in terms of their trade coverage and the level of tariffs imposed.

- G20 economies also implemented 29 new measures aimed at facilitating trade, including eliminating or reducing import tariffs, export duties and eliminating or simplifying customs procedures for exports. The trade coverage of the import-facilitating measures implemented during the review period is estimated at USD 397.2 billion, which is 1.8 times higher than in the previous G20 Report.

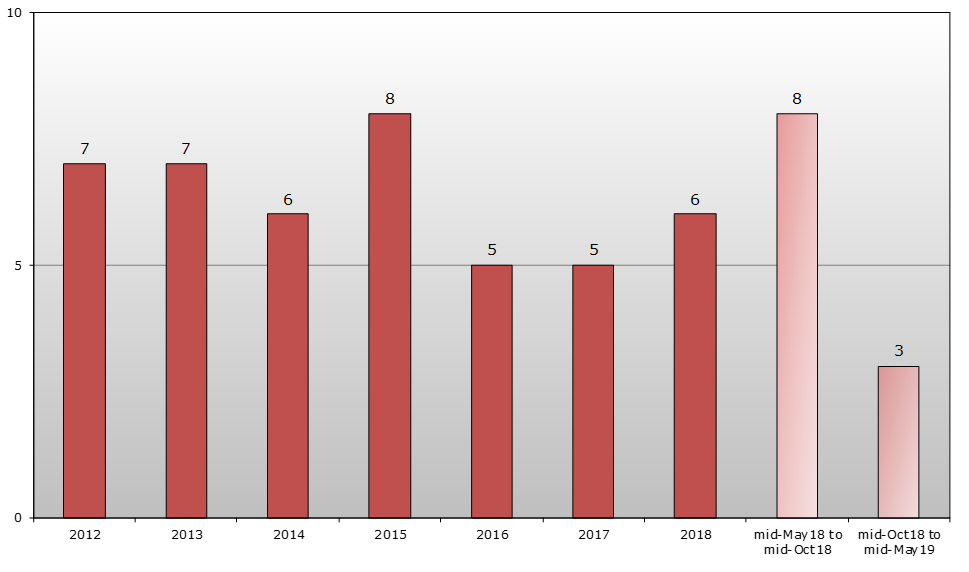

- The monthly average of 12 initiations of trade remedy actions during the review period is the lowest registered since 2012. The trade coverage of trade remedy initiations (USD 18.4 billion) has fallen compared to the previous period. The trade coverage of trade remedy terminations recorded in the review period (USD 14.6 billion) is two and a half times higher than that reported in the previous G20 Report.

- This Report highlights the continuing challenges in global trade. G20 economies must follow through on their commitment to trade and to the rules-based international trading system and work together urgently to ease trade tensions and to improve and strengthen the WTO.

Trade coverage of new import-restrictive measures in each reporting period (not cumulative)

(USD billion)

Note: These figures are estimates and represent the trade coverage of the measures (i.e. annual imports of the products concerned from economies affected by the measures) introduced during each reporting period and not the cumulative impact of the trade measures.

Source: WTO Secretariat.

Trade coverage of new import-facilitating measures in each reporting period (not cumulative)

(USD billion)

Note: These figures are estimates and represent the trade coverage of the measures (i.e. annual imports of the products concerned from economies affected by the measures) and not the impact of the trade measures. Liberalization associated with the 2015 Expansion of the WTO's Information Technology Agreement is not included in the figures.

Source: WTO Secretariat.

G20 Trade-restrictive measures

(Average per month)

Values are rounded. Changes to averages of previous years reflect continuing fine tuning and updates of the TMDB.

Source: WTO Secretariat.

G20 Trade-facilitating measures

(Average per month)

Values are rounded. Changes to averages of previous years reflect continuing fine tuning and updates of the TMDB.

Source: WTO Secretariat.

G20 Trade remedy initiations and terminations

Source: WTO Secretariat.

G20 measures, mid-October 2018 to mid-May 2019

(by number)

Source: WTO Secretariat.

Trade coverage of G20 measures, mid-October 2018 to mid-May 2019

(USD billion)

Source: WTO Secretariat.

Share

Problems viewing this page? If so, please contact [email protected] giving details of the operating system and web browser you are using.