WTO TRADE BAROMETERS

More

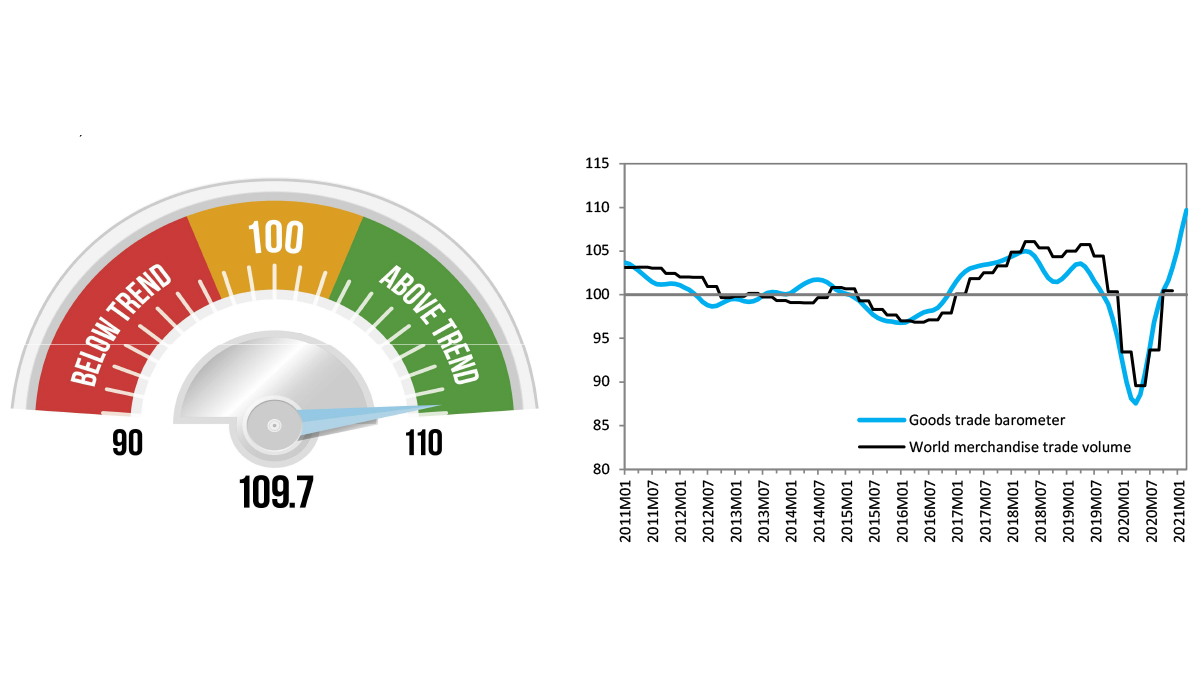

The Goods Barometer is a composite leading indicator for world trade, providing real-time information on the trajectory of merchandise trade relative to recent trends. The barometer's current reading of 109.7 is nearly 10 points above the baseline value of 100 for the index and up 21.6 points year-on-year, reflecting both the strength of the current recovery and the depth of the COVID-19 shock last year.

In the latest month, all of the barometer's component indices were above trend and rising, highlighting the broad-based nature of the recovery and signalling an accelerating pace of trade expansion.

Among the barometer’s component indices, the biggest gains were seen in export orders (114.8), air freight (111.1) and electronic components (115.2), all of which are highly predictive of near-term trade developments. The strength of the automotive products index (105.5) may reflect improving consumer sentiment, since confidence is closely linked to sales of durable goods. This is also true of agricultural raw materials (105.4), which are mostly made up of wood intended for housing construction. Finally, the strong showing for container shipping (106.7) is more impressive in light of the fact that sea shipments held up well during the pandemic and had less ground to make up as a result.

The latest barometer reading is broadly in line with the WTO's current trade forecast issued on 31 March, which predicted an 8% pickup in the volume of world merchandise trade in 2021 following a 5.3% decline the previous year. The relatively positive short-term outlook for trade is marred by regional disparities, continued weakness in services trade and lagging vaccination timetables, particularly in poor countries.

Global trade has been recovering since the second quarter of 2020, when the spread of the COVID-19 virus prompted lockdowns in many countries and triggered a steep drop in world trade. The volume of merchandise trade was down 15.5% year-on-year in Q2, when lockdowns were in full effect, but by the fourth quarter trade had surpassed the level of the same period in 2019.

While quarterly trade volume statistics for the first and second quarters of 2021 have not been released yet, they are expected to show very strong year-on-year growth, partly due to the recent strengthening of trade and partly as a result of the trade collapse last year. However, COVID-19 continues to pose the greatest threat to the outlook for trade, as new waves of infection could easily undermine the recovery.

The full Goods Trade Barometer is available here.

Further details on the methodology are contained in the technical note here.

Share

Share

Problems viewing this page? If so, please contact [email protected] giving details of the operating system and web browser you are using.