MORE:

> Joint Summary on G-20 Trade and Investment Measures (OECD/WTO/UNCTAD)

> WTO Report on G-20 Trade Measures (mid-October 2014 to mid-May 2015)

> Summary and Status of G-20 trade and trade-related measures since October 2008 (Excel Format)

> OECD/UNCTAD Report on G-20 Investment Measures

Key findings

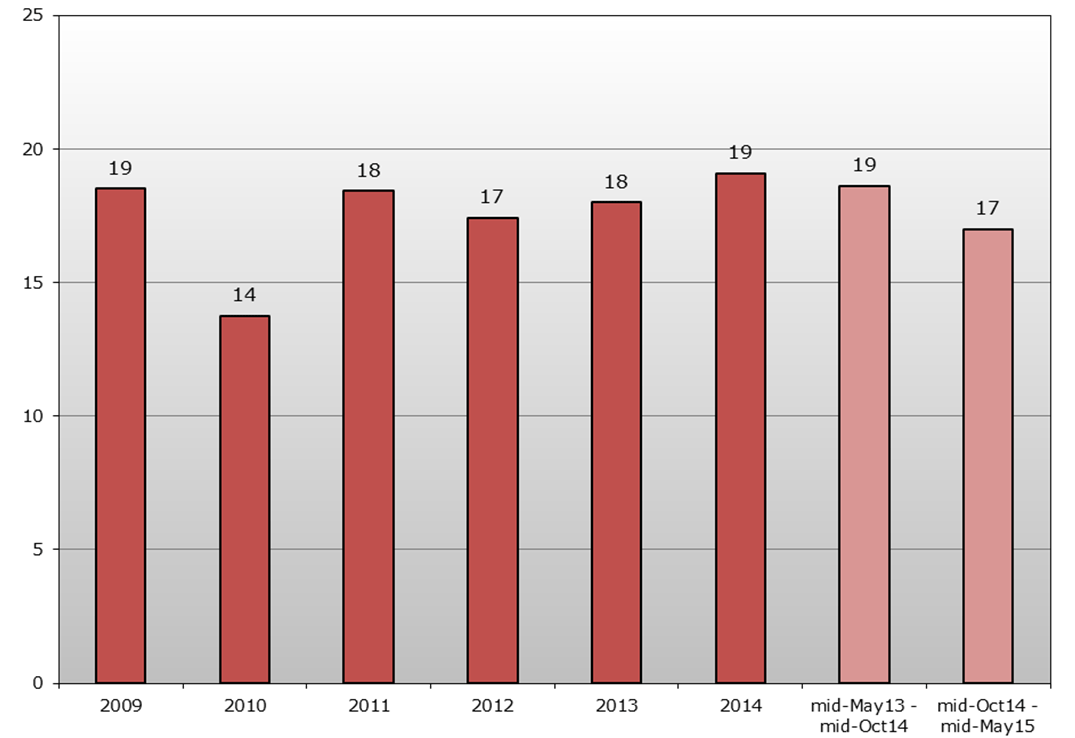

- This report shows a slight deceleration in the application of new trade-restrictive measures by G-20 economies with the average number of such measures applied per month lower than at any time since 2013. Since mid-October 2014, 119 new trade-restrictive measures were put in place over the period — an average of 17 new measures per month.

- Also during this period, G-20 economies continued to adopt measures aimed at facilitating trade. The trend on these trade liberalizing measures remains stable with G-20 economies introducing some 112 new measures during the period under review — an average of 16 measures per month.

- Despite these recent trends, it is not yet clear that the deceleration in the number of measures introduced will continue in future reporting periods. Therefore, continued vigilance and reinforced determination towards eliminating existing trade restrictions remains an important priority.

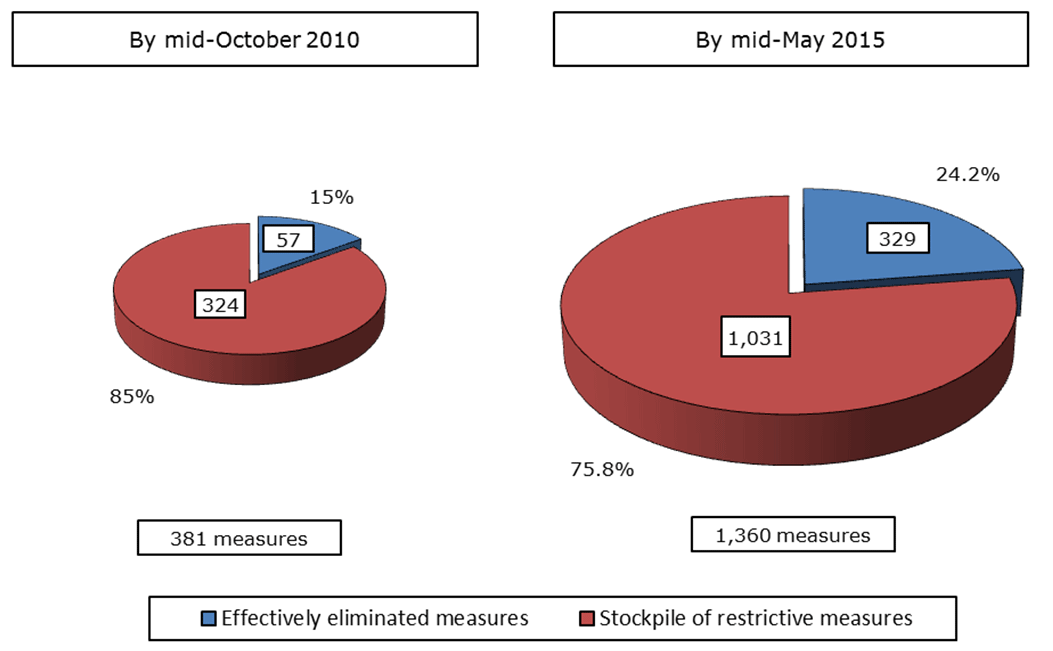

- The longer‑term trend remains one of concern with the overall stock of trade-restrictive measures introduced by G-20 economies since 2008 continuing to rise. Of the 1,360 restrictions recorded by this exercise since 2008, less than a quarter have been eliminated, leaving the total number of restrictive measures still in place at 1,031. Therefore, despite the G-20 pledge to roll back any new protectionist measures the stock of these measures has risen by over 7% since the last report.

- The broader international economic context also supports the need for continuing vigilance and action. According to the WTO’s most recent forecast (14 April 2015), growth in the volume of world merchandise trade should increase from 2.8% in 2014 to 3.3% in 2015 and further to 4.0% in 2016, but remaining below historical averages.

- While the stock of trade restrictive measures has risen, the overall response to the 2008 crisis has been more muted than expected when compared with previous crises. The multilateral trading system has proved an effective backstop against protectionism.

- This role in providing a stable, predictable and transparent trading environment should be kept in mind as Members prepare for the WTO’s tenth Ministerial Conference in Nairobi in December.

- The G-20 must continue to show leadership in eliminating remaining trade-restrictive measures and in the pursuit of further multilateral trade liberalization.

Trade-restrictive measures (average per month)

Source: WTO Secretariat.

Stockpile of restrictive measures

Source: WTO Secretariat.

Executive Summary

This is the thirteenth trade monitoring report on G-20 trade measures. It covers the period from 16 October 2014 to 15 May 2015.

This report shows a slight deceleration in the application of new trade-restrictive measures by G‑20 economies with the average number of such measures applied per month lower than at any time since 2013. Since mid-October 2014, G-20 economies applied 119 new trade-restrictive measures over the period — an average of 17 new measures per month. A slight decrease in the number of trade remedy investigations by G-20 economies has also contributed to this overall figure.

During this period, G-20 economies also continued to adopt measures aimed at facilitating trade, both temporary and permanent in nature. The trend on trade‑liberalizing measures thus remains stable with G-20 economies introducing some 112 new measures during the period under review –an average of 16 measures per month. When counted without trade remedy actions, G-20 economies have adopted more liberalizing import measures than restrictive measures since the end of 2013.

These developments confirm that G-20 economies overall have shown a degree of restraint in introducing new trade restrictions during this reporting period. However, it is not yet clear that the deceleration in the number of measures introduced will continue in future reporting periods. It is also relevant that the slow pace of removal of previous restrictions means that the overall stock of restrictive measures is continuing to increase.

Overall, this report shows that of the 1,360 restrictions recorded by the monitoring exercise since October 2008, only 329 have been removed. In other words, the total number of those restrictive measures still in place currently stands at 1,031 — up by over 7% compared to the last report. The addition of new restrictive measures, combined with a removal rate which fails to significantly reduce the overall stockpile of restrictive measures, is inconsistent with the longstanding G-20 pledge to roll back protectionist measures. With the share of removals of total restrictive measures still under 25%, the longer term trend in the number of trade restrictive measures remains one of concern. Therefore, continued vigilance and reinforced determination towards eliminating existing trade restrictions remain an important priority.

The broader international economic context also supports the need for continuing vigilance and action. Trends in world trade and output have remained mixed since the last monitoring report, as merchandise trade volumes and GDP growth picked up in the second half of 2014 but appear to have slowed in the first quarter of 2015. Economic activity remained uneven across countries as the United States (US) and China slowed in Q1 while growth in the euro area and Japan picked up. Plunging oil prices and strong exchange rate fluctuations — including an appreciation of the US dollar and a depreciation of the euro — contributed uncertainty to the economic outlook. Lower prices for oil and other primary commodities were expected to provide a boost to importing economies, but reduced export revenues weighed heavily on commodity exporters. In light of these developments, the Secretariat’s most recent forecast (14 April 2015) predicted a continued moderate expansion of trade in 2015 and 2016, although the pace of recovery was expected to remain below historical averages. According to this forecast growth in the volume of world merchandise trade should increase from 2.8% in 2014 to 3.3% in 2015 and further to 4.0% in 2016.

In the area of government procurement, work from the OECD identifying 65 measures implemented since the financial crisis, suggests that discriminatory government procurement policies have become increasingly popular and potentially affect US$423 billion of government procurement in the implementing economies.

This report shows that G-20 economies implemented 48 new general economic support measures during the period under review with the majority targeting the manufacturing and agricultural sectors through various incentive schemes, often, but not exclusively, in the context of exports.

From transparency and systemic points of view, important developments took place in the WTO’s TBT and SPS Committees. Although an increase in the number of notifications does not automatically imply greater use of measures taken for protectionist purposes, both Committees saw record levels of notifications in 2014 driven by a significant growth in notifications from developing countries. The number of specific trade concerns raised in the TBT Committee has increased significantly lately.

Among G-20 countries a number of recent policy developments in services are noteworthy. These include reforms of the insurance and pension sectors and easing of the rules on foreign investment in the construction and railway transportation sectors in India, as well as the lifting of restrictions on foreign investment in several service sectors in China. Also noteworthy is the amendment of the Russian Law on Foreign Investment in Strategic Companies and several important reforms in the audio-visual and ICT sectors by Argentina, Mexico, the Russian Federation and the US.

The overall assessment of this thirteenth report on G-20 trade measures is that the continuing increase in the stock of new trade-restrictive measures recorded since 2008 remains of concern in the context of an uncertain global economic outlook. The G-20 individually and collectively must show leadership and deliver on their pledge to refrain from implementing new measures taken for protectionist purposes and to remove existing ones.

While the stock of trade‑restrictive measures has risen, the overall response to the 2008 crisis has been muted when compared with previous crises. The multilateral trading system has thus proved an effective backstop against protectionism, and the system must do more to drive economic growth, sustainable recovery and development. The role of the multilateral trading system in providing a stable, predictable and transparent trading environment should be kept in mind as Members prepare for the WTO’s MC10 in Nairobi in December. Decisive progress in eliminating remaining trade-restrictive measures combined with further multilateral trade liberalization would be a powerful policy response.

> Problems viewing this page?

Please contact [email protected] giving details of the operating system and web browser you are using.