INTELLECTUAL PROPERTY: WHO-WIPO-WTO BOOK

Chapter 3: Medical technologies: the innovation dimension

Chapter II has described the main elements of the policy framework for innovation and access. This chapter considers how this policy framework applies to innovation in medical technologies. It reviews the factors that have spurred innovation in medical technologies in the past, identifies how current models of research and development (R&D) are evolving, charting the role of established and new participants in the innovation process, including in the context of neglected diseases. It also covers issues raised in the area of intellectual property (IP), particularly the patent system.

The chapter reflects the fact that health policy-makers in the past decade have paid greater attention to the innovation dimension, considering in particular:

- the kind of collaborative structures, incentive mechanisms, sources of funding and informatics tools that are required in order to build more effective and more broadly-based and inclusive innovation processes

- how to ensure that medical research activities focus increasingly on areas neglected so far.

A. Historical pattern of medical R&D

Key point |

|

1. Innovation for medical technologies in context

Innovation in medical technologies is distinct from innovation in general. It is characterized by several distinguishing features:

- The need for a rigorous regulatory framework to assess medical technologies in terms of their quality, safety, and efficacy or effectiveness.

- The high costs of research and development (R&D) and the concomitant high risk of failure.

- A high level of public-sector input, in terms of input from basic research, funding and infrastructure and also in terms of influencing the market for finished products.

- The inherent ethical component of medical research, and the potential negative impact on public health of closely held or overly restrictive management of technology and intellectual property (IP).

Historical trends in medical R&D and the development of the modern pharmaceutical industry provide context for the dynamics of current developments and the challenges facing the existing innovation system and overall R&D landscape and are therefore important to understand.

2. From early discoveries to “wonder drugs”

Despite important medical discoveries in the 18th and 19th centuries, at the beginning of the 20th century, few medicines were available to treat basic infectious diseases. Prior to the 1930s, the pharmaceutical industry did not invest in R&D to any great extent. However, the discoveries in Europe that certain chemicals and microorganisms could be used to treat infections led to the development of a range of derivative products which served as effective anti-bacterial agents. Producing at industrial scale proved to be another challenge. For example, it was only in 1939, ten years after Alexander Fleming discovered penicillin, that mass manufacture of penicillin got under way at US Department of Agriculture facilities. Subsequently, private pharmaceutical companies were enlisted to develop and market the drug. It is notable that while both penicillin and sulphanilamide formed the basis of a generation of new “wonder drugs” or antibiotics, neither was patented. These medicines were developed and marketed in collaboration with teams of researchers from both not-for-profit organizations and private enterprises.

3. Growth and evolution of the modern pharmaceutical industry

The turmoil of war and migration, among other factors, led to the shift of leadership in the pharmaceutical industry from Europe, particularly Germany, to the United States, although trans-Atlantic rivalries continued to be sharp. The mid-1940s saw the rise of the US-based pharmaceutical industry, and several factors influenced this, including the introduction of regulation on prescription drugs and changes in how patent law was applied.1 The interplay between these two specific factors helped develop the modern, vertically integrated pharmaceutical firm which undertakes both in-house R&D and marketing. From 1950 to 1970, the ratio of R&D investments to sales revenues in the US pharmaceutical industry more than doubled, while the ratio of advertising expenses to sales revenues was even higher. Most of the marketing expenditure comprised the cost of informing and influencing doctors on prescription medicines. The period from the late 1940s onwards saw an increase in the grant of both product and process patents for pharmaceuticals.2 During the period 1950 to 1970, the pharmaceutical industry returned consistently higher levels of profits than most manufacturing companies at that time.

Tight control of R&D and marketing was necessary because these companies derived most of their revenues from a very small number of successful products (Comanor, 1986). The basis for competition among these companies changed from price factors to non-price factors, such as research and advertising outlays and outputs. This model helped to incentivize innovation – the US R&D-based pharmaceutical industry moved from an average of 20 new products per year in the 1940s to an average of 50 new products per year in the 1950s.

The period 1930 to 1960 saw the introduction of innovations in organic and natural products chemistry, which in turn led to the isolation and synthesis of vitamins, corticosteroids, hormones and anti-bacterial agents. The following years were marked by the industry moving from chemistry-basedR&D and manufacturing to pharmacology and life sciences-based activities. Also during this period, a phased system for developing new medicines was established – the so-called “Phase I – IV” system for clinical trials.3

4. From non-exclusive licensing to restricted production

In the period up to 1960, a key development was that innovative companies began to exclusively produce products themselves, without licensing them to others. This enabled them to restrict output and generate larger profits. A practice of licensing with high royalty payments could potentially have delivered the same profits to these innovator companies, but such royalty payment rates would have had to be very high in the face of inelastic demand (i.e. consumers’ demand for a product does not change appreciably in response to a one-per-cent increase in price). By one estimate, when demand is inelastic, the royalty rate required to yield a return equivalent to an exclusive, single supply model would be 80 per cent (Temin, 1979). Relatedly, one estimate of the wholesale price of tetracycline, before the introduction of generic versions of this medicine in the United States, was US$ 30.60 per 100 capsules, whereas the production cost for the same quantity was just US$ 3.00, thus generating a profit rate of 90 per cent. Such high royalty rates would have been commercially unacceptable as royalty rates at that time were typically just 2.5 per cent. Apart from being the rate at which streptomycin was licenced, the 2.5-per-cent rate would have also applied in a US Federal Trade Commission (FTC) decision relating to a compulsory licence for tetracycline. However, this FTC decision did not subsequently enter into force for other reasons (Scherer and Watal, 2002).

These conditions of exclusivity and product differentiation extended beyond antibiotics to all medicines obtained through R&D. For instance, the first generation of steroids was widely licensed, while the second generation of synthetic steroids was exclusively produced by patent-owning companies (Temin, 1979).

5. R&D productivity: early gains, regulatory concerns

Between 1961 and 1974, the world’s pharmaceutical companies introduced some 83 new molecular entities (NMEs) per year. By the late 1980s, this had declined to 50 NMEs per year. Between 1961 and 1990, 2015 NMEs were successfully marketed (Ballance et al., 1992, p. 86). More than 90 per cent of all new drugs were discovered and developed by pharmaceutical companies operating in Belgium, France, Germany, Italy, Japan, the Netherlands, Sweden, Switzerland, the United Kingdom and the United States (Ballance et al., 1992, p. 108).

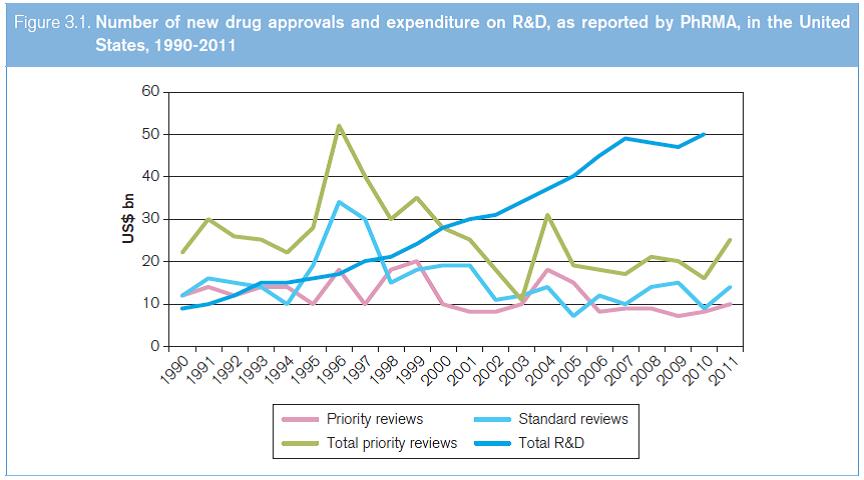

This period was marked by the availability of several competing new drugs to treat the same disease, largely a consequence of the introduction of “me-too” drugs to compete with breakthrough, new drugs. In order to finance their investments in R&D and marketing, companies had to have a steady stream of new, improved drugs which could attract a price premium globally. That there have been relatively few new drug approvals, and even fewer new important breakthrough drugs in relation to the R&D expenditures, can be seen from the total priority and standard reviews approved in the US Food and Drug Administration. This is despite the fact that R&D expenditure in the private sector rose fivefold between 1990 and 2010 (see Figure 3.1).

Source: WHO (2012a).

As early as 1959, the Kefauver Committee report accused the industry of price gouging through duplicative research and molecule manipulation to create therapeutically equivalent products. Sceptical views expressed in the current global debate about the benefits of competition, and the appropriate level of returns for innovation in the context of biomedical R&D, echo some of these early criticisms. The 2006 Congressional Budget Office report summed up the situation as follows: “The more accurately a drug’s price reflects its value to consumers, the more effective the market system will be at directing R&D investment toward socially valuable new drugs. However, prices can only serve that directing role to the extent that good information exists about the comparative qualities of different drugs and that consumers and health care providers use that information” (USCBO, 2006, p. 5). Certain criticisms of the industry notwithstanding, there is little doubt that modern medicines and technologies have contributed to longevity, especially in countries that have access to newer medicines (Lichtenberg, 2012).

1. This section is largely based on Temin (1979). back to text

2. Streptomycin was introduced commercially in 1946 under a patent granted in 1948. However, scientists at Rutgers University who were involved in the discovery of streptomycin convinced the originator company to license it on an unrestricted basis at a royalty rate of 2.5 per cent and to assign the patents to the Rutgers Research Foundation. In the United States, competition drove down the price of streptomycin from US$ 4,000 per pound to US$ 282 per pound by 1950. back to text

3. For more information, see Chapter II, Section A.6(b). back to text