B. The current R&D landscape

Key points |

|

|

|

|

|

|

|

|

This section reviews the challenges faced by today’s pharmaceutical industry, against the background of its evolution outlined in the previous section.

1. A time of challenge for the pharmaceutical industry

The conventional innovation model in the pharmaceutical industry faces considerable challenges, not only with regard to the way innovation is carried out through knowledge networks, but also with regard to the marketplace it is seeking to serve (Tempest, 2011). The structure of the industry itself is evolving, including through mergers and acquisitions among R&D-based companies, in a bid to strengthen innovative pharmaceutical pipelines. It is also evolving as a result of acquisitions of generic pharmaceuticals companies by R&D-based companies and vice versa, thus blurring the traditional boundary between R&D-based companies and generic drugs companies.

Additional drivers of change in business models and in industry structure include:

- Growing diversity in innovation models and pathways to product development – with dynamic competitive pressures growing not merely between individual companies but also between distinct innovation strategies. For example, the exploration of the use of virtual R&D by leading R&D-based pharmaceutical companies – in terms of information and communications technology (ICT) that would involve the use of collaborative models (PwC, 2008).

- Regulatory processes, including more stringent safety standards and post-marketing surveillance, due to lower acceptance of risk.

- Expiry of patents on key blockbuster drugs (“patent cliffs”), one estimate is that, between 2012 and 2018, patent expiry and consequent generic entry will reduce revenues of R&D-based pharmaceutical companies by about US$ 148 billion (PwC, 2012).

- A greater concentration on emerging economies – both as a rapidly growing market for medical technologies and as an increasingly viable base for research, development and effective commercialisation of research. For example, non-OECD economies accounted for 18.4 per cent of the world’s R&D, up from 11.7 per cent in 1996 (PwC, 2008).

- Emergence of biologics that cannot be replicated as easily as can new small molecule pharmaceuticals (see further explanation below).

- Slowing demand in developed-country markets due to the recession and competing pressures on government budgets, and the shift in focus to emerging markets due to higher growth in demand there.

The latest wave of innovation in medical technologies, gathering pace from around 1980, is based on advances in the discovery and application of biotechnology. The growing use of bioinformatics in virtual R&D to create computer models of organs and cells offers significant potential for tailored drug discovery and development (PwC, 2008). The decoding of the human genome in the late 1990s spurred hopes of a new wave of innovation in personalized medicine. However, the promise of genomics delivering more precise diagnostics and medicines, also dubbed “precision medicines”, has yet to be fully realized (Pray, 2008).

Changes are also occurring in the way innovation is taking place. The increasing importance of emerging economies markets for the industry, for example, leads the medical devices industry to adapt their innovation models to the specific demands of these markets (see Box 3.1).

2. Public-sector researchers play a key role in medical R&D

In the first phase of modern medical R&D, most products were developed by private companies, with little attention paid to understanding the causes of particular illnesses and diseases, or to understanding metabolic pathways. It required a determined effort on the part of governments to bring the insights from public-sector research to bear on the product development priorities of the private sector. The division of labour between the private sector and the public sector during these later “waves” of innovation was such that the public sector began to concentrate on upstream research that provided basic scientific knowledge on the mechanisms of disease and immune reactions. As a result of the concentration on this area, researchers identified the entry points for effective medications. Companies then focused on downstream applied research and the development of products and, by doing so, they translated basic research into medical products. The main reason for this division of labour was that, globally, the vast majority of early stage research – which is essentially not marketable or profitable as such – is funded by governments and other public-sector institutions. The public sector thus significantly influences the innovation cycle by shaping research priorities, at least with regard to basic research (WHO, 2006b; USCBO, 2006).

Today, public-sector bodies continue to have an impact on early-stage drug development, but they also play an important role in the innovation cycle at subsequent stages. Governments, for example, control the quality of health products through their regulatory frameworks, which determine whether a product gets to the market and, if so, how quickly. Additionally, the public sector plays a critical role in the delivery phase of health products because governments are usually the main purchasers of health products and they often organize the distribution and delivery of such products.

Box 3.1. Adapting innovation to local needs in the medical devices industry |

Increasingly, private-sector medical devices companies are seeking to specifically design new devices and health care delivery models which can be adapted to the needs of LMICs. These actions reflect a growing level of commitment among companies to serve long-neglected markets; they also reflect companies’ greatly increased interest in the commercial opportunities arising from addressing the health needs of people who inhabit the middle and bottom of the socio-economic pyramid. As a result, companies are committing greater resources towards evaluating local and regional barriers, and are creating tailored products and services to meet specific cultural or geographic needs. One of the outcomes of this development is devices that are more adapted to the needs of LMICs. Such devices are also less costly than those designed for markets in high-income countries and are thus more affordable. The design of the devices may also serve to enhance accessibility. The development of a portable and more affordable version of the common electrocardiograph – aimed at increasing access to health care in low-income rural areas – is an interesting example.1 |

Box 3.2. The case of paclitaxel |

Screening of the Pacific yew tree for therapeutic effect was initiated as a cooperative venture between the US Department of Agriculture and the National Cancer Institute (NCI) at the NIH. In 1964, extracts from the bark of the Pacific yew tree were tested against two cancer cell lines and were found to have promising effects. In 1969, following research on extracts from the bark of the tree, the active compound, paclitaxel, was isolated. In 1979, the pharmacologist Susan Horwitz and her co-workers at the Albert Einstein College of Medicine at Yeshiva University reported a unique mechanism of action for paclitaxel. In 1983, the NCI supported clinical trials with paclitaxel, and in 1989, NCI-supported clinical researchers at Johns Hopkins University reported very positive effects in the treatment of advanced ovarian cancer. Also in 1989, the NCI reached an agreement with a pharmaceutical company to increase the production, supply and marketing of paclitaxel. Paclitaxel began to be marketed for the treatment of ovarian cancer in 1992. Subsequently, the pharmaceutical company adopted a semi-synthetic process for manufacturing the product.2 |

In order to support biomedical sciences, and also to facilitate research at universities, some governments set up dedicated research institutes in the late 19th and early 20th century. Thus began the interaction between universities and government research institutions, which carried out the basic research, and the private sector, which developed and commercialized medicines based on this research. In recent years, a number of universities have developed extensive patent portfolios and many of the new companies focusing on biotechnology are originally spin-offs from universities. Non-profit entities play an important role in the funding of biomedical research, principally in high-income countries – the Howard Hughes Medical Institute in the United States and the Wellcome Trust in the United Kingdom are good examples of this type of initiative. In the developing world, research institutions are also beginning to build up substantial patent portfolios. For example, in January 2013, the Council for Scientific and Industrial Research in India held 702 patents on medicines and 450 patents in biological sciences.3 The US government provides significant funding for medical R&D, especially through the National Institutes of Health (NIH).

The story of the development and marketing of paclitaxel provides an example of how public and private enterprise can cooperate in the development of new discoveries and new drugs (see Box 3.2).

A recent study suggests that public-sector research has had a more immediate effect on improving public health than might be expected (Stevens et al., 2011). According to the study, of the 1,541 US Food and Drug Administration (FDA) approvals between 1990 and 2007, a total of 143 (9.3 per cent) related to drugs developed as a result of public-sector research. However, of the 348 priority reviews, 66 drugs (19 per cent) had resulted from public-sector research. In other words, public-sector research accounted for twice the overall priority reviews rate. Viewed from another perspective, 46.2 per cent of new-drug applications from public-sector research received priority reviews. This compares with 20 per cent of new drug applications, which were developed solely as a result of private-sector research, thus representing an increase by a factor of 2.3. Therefore, products resulting from public-sector funded research apparently have a greater therapeutic effect than those resulting from private sector research.

3. Medical R&D costs

One of the main arguments put forward by industry with respect to the need for strict protection of IPRs is the high cost of R&D for new medical products. Developing a pharmaceutical product from laboratory stage to marketing stage takes a long time and entails the additional burden of complying with stringent regulatory approval processes, thus resulting in a small number of successful products. There are, however, few sources of data available that enable the true costs of medical research to be assessed.

According to the report on the European Commission pharmaceutical sector inquiry covering the period 2000 to 2007, European originator companies spent an average of 17 per cent of turnover generated from sales of prescription medicines on R&D. Approximately 1.5 per cent of turnover was spent on basic research to identify potential new medicines, while 15.5 per cent of turnover was spent on developing the identified potential medicines through clinical trials on products. As in earlier decades, marketing and promotional activities exceeded R&D costs, accounting for 23 per cent of originator companies’ turnover during this period.4

While these figures reveal the costs of research in relation to originator companies’ overall turnover, a number of estimates have been made about the average absolute costs of R&D for new medicines. Costs greatly depend on the type of medicine in question. There is a huge difference in costs between a medicine based on a new chemical entity (NCE) not previously used in any pharmaceutical product, and an incremental modification of an existing medicine. However, even for NCEs the stated costs differ widely.

In 2007, the Pharmaceutical Research and Manufacturers of America (PhRMA) estimated that it takes between 10 and 15 years to bring a new medicine (based on an NCE) from discovery to market at an average cost for R&D of US$ 800 million to US$ 1 billion. This estimate included the costs of failed research projects (PhRMA, 2007). In 2011, PhRMA estimated the average cost at more than US$ 1.2 billion.5 Such figures are derived from a study carried out by DiMasi et al. (2003), who estimate that the average cost per NCE was US$ 802 million in 2000 for small-molecule drugs, and US$ 1,318 million in 2005 for biologics (DiMasi and Grabowski, 2007). Included in these costs are substantial opportunity costs. A more recent publication, Munos (2009), suggests that current research costs are higher than the average costs cited by DiMasi et al. (2003).

A systematic overview, which involved assessing publications dealing with the cost of developing pharmaceuticals, found that estimations of R&D costs varied more than ninefold – from US$ 92 million (US$ 161 million capitalized) to US$ 883.6 million (US$ 1.8 billion capitalized). Some of these variations can be explained by different methods, data sources and time periods, but the authors emphasize that there is a lack of transparency, as confidential information provided by unnamed companies about unspecified products formed all or part of the data for most of the studies referred to in the publications assessed as part of the overview process (Morgan et al., 2011).

All of these estimations rely on many variables, such as the estimated average length of development, the average size and costs of clinical trials, and the probability of success that products will finally make it to market. In addition, it is difficult to verify the underlying data, as this is not disclosed. These figures have been widely discussed and challenged (Love, 2003; Light and Warburton, 2011). There are also doubts about the usefulness of such estimations, as costs vary widely between companies and also between the private sector and the public sector.

While there is no agreement on precise costs, it is obvious that medical R&D is very costly and highly risky, and that many investments do not result in a return, due to product failures in the clinical trials phase. Rapidly drying up or non-existent pipelines for innovative blockbuster products is the reason for the increase in mergers and acquisitions in this sector, and is also the reason for the declining stock valuations of even the largest pharmaceutical companies in recent years.

4. Incentive models in the innovation cycle

The 2011 World Intellectual Property Report (WIPO, 2011a) observes that “IP rights are a useful incentive mechanism when private motivation to innovate aligns with society’s preferences with regard to new technologies. But such an alignment does not always exist. In addition, it is unclear whether the IP system can incentivize invention that is far from market application, for example basic science research”. In reviewing the IP system in the context of the broad sweep of innovation policies, the report distinguishes three mechanisms for promoting innovation:

- Publicly funded innovation carried out by academic institutions and public research organizations.

- Publicly funded research undertaken by private firms – notably through public procurement, research subsidies, soft loans, R&D tax credits and innovation prizes.

- Privately financed and executed R&D, financed through the marketplace rather than government revenues and incentivized through the IP system, which is one mechanism of government policy that promotes innovation.

Source: WHO (2006b, p.23)

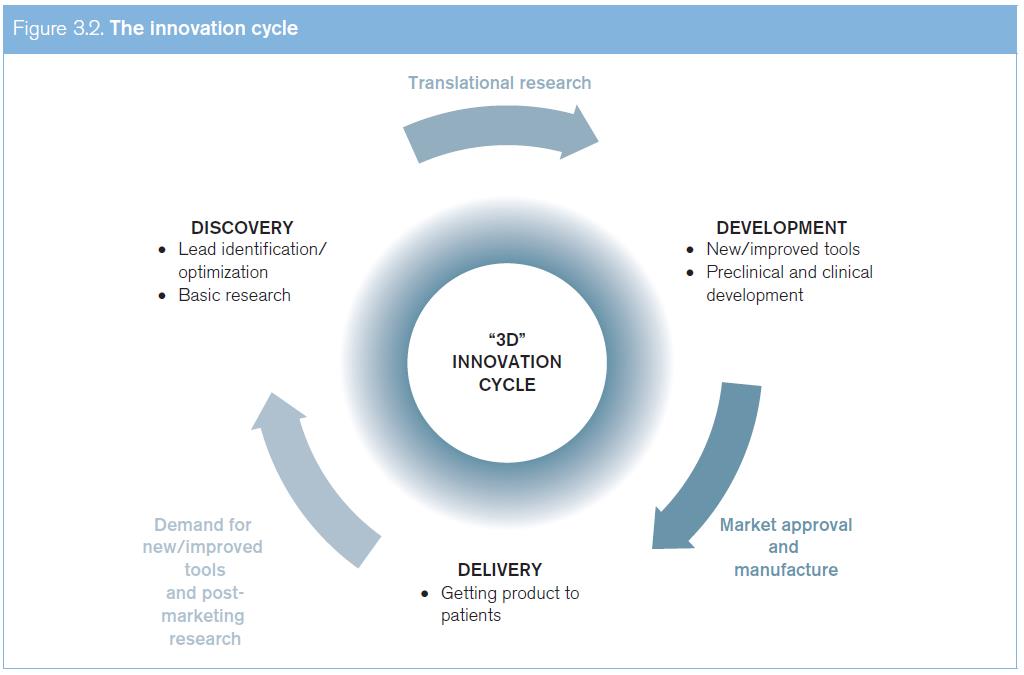

(a) The innovation cycle

Innovation is often presented as a linear process that culminates in the launch of a product, but innovation in health can also be seen as a cycle (see Figure 3.2). This cycle goes from R&D of new, basic compounds to the testing and development of new products, up to the delivery of these products, and then returning to the R&D of new products (or to the optimization of existing products) through systematic post-marketing surveillance and the development of an increasingly effective demand model based on health needs.

The circular model of health innovations illustrates a critical reality: the current market-driven innovation cycle works better for developed countries where effective demand for health products is matched by the ability to pay for them. In contrast, for diseases that predominantly affect patients in developing countries, there is a critical gap in the availability of incentives that fuel the conventional innovation cycle. While there is an urgent need for new medications for diseases that predominantly affect developing countries, that market is characterized by limited purchasing power, coupled with the lack of health insurance systems in many countries.

(b) Absence of self-sustaining innovation cycle in the case of small markets, low incomes

The CIPIH in this context observed that the IP system needs a certain type of environment in order to deliver expected results. In low-income countries, the innovation cycle is not self-sustaining due to small markets, underfunded health services and generally weak upstream research capacity. In this type of environment, IPRs alone do not provide an efficient incentive for medical research (WHO, 2006b). Member states subsequently confirmed this finding in the WHO Global Strategy and Plan of Action on Public Health, Innovation and Intellectual property (GSPA-PHI).6

This gap – between the specific needs of developing countries and the medical research effort – has sparked policy debate on the effectiveness of current medical innovation structures for the needs of developing countries, both in terms of the disease burden addressed and in terms of how appropriate the solutions found are for those suffering from disease. Equally, the compelling need to address this gap has, over the past decade, prompted an array of practical initiatives to find new ways of combining the diverse inputs, infrastructure and resources needed for product development. These initiatives have explored new ways of integrating these different inputs and steering candidate products through the innovation process, culminating in the delivery of safe and effective new technologies. This approach has typically made use of more collaborative structures, a wider range of non-exclusive and segmented technology licensing models, the development of pre-competitive technology platforms, as well as product development partnerships (PDPs) that harness private-sector capacities and deploy them towards the attainment of not-for-profit public health objectives. Such practical initiatives both respond to, and help to influence, the dynamics of medical innovation today, both in terms of making new technologies available and illustrating in practice the possibilities for a wider range of innovation models.7

While it is important to trigger the requisite innovation for neglected diseases, it is also important to ensure that any new medical technologies emerging from such initiatives are affordable for the people who need them. In the existing patent-driven innovation ecosystem, the returns for investment in innovation are generally factored into the price of new generation products. In contrast, new and innovative finance mechanisms and initiatives aim not to finance the cost of R&D through the price of the end product, thus delinking the cost of research from the price of the product.8

There have been a few successful cases of tailoring innovation to meet identified medical needs. An example is the development of a meningitis vaccine for Africa (see Box 3.3).

(c) Building innovation networks

The CIPIH stressed that the formation of “effective networks, nationally and internationally, between institutions in developing countries and developed countries, both formal and informal” is an “important element in building innovative capacity” (WHO, 2006b). Among current initiatives to build such collaborative networks for innovation is the African Network for Drugs and Diagnostics Innovation in Africa (ANDI) (see Box 3.4).

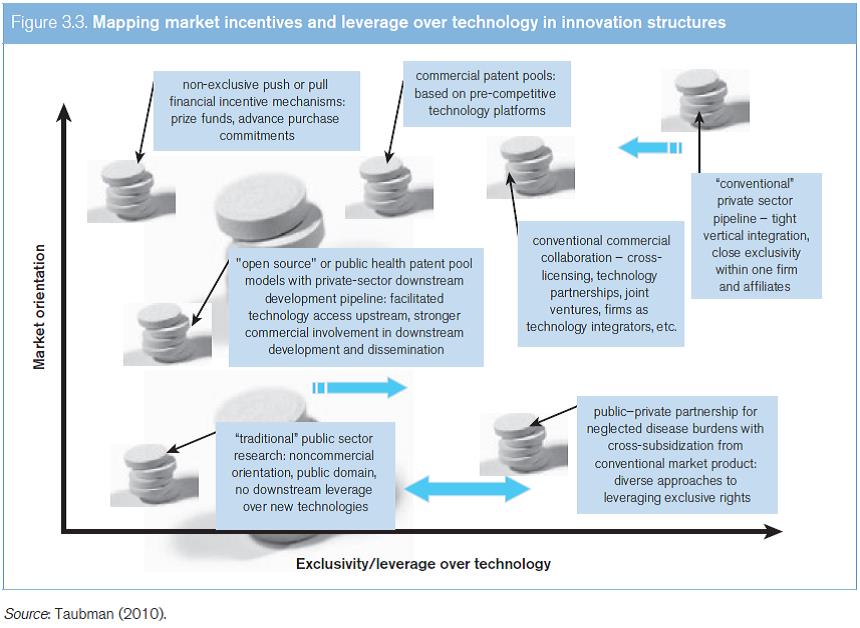

(d) Overview of innovation structures

A broad range of diverse innovation structures are used in the development of medical technologies. As Figure 3.3 illustrates, these structures can be characterized according to two factors – the degree of market-based incentives involved, and the extent to which some leverage or exclusivity is exercised over the technology. Often innovation processes are neither situated in an entirely non-commercial context with no leverage at all maintained over technologies, nor a rigid, highly exclusive and entirely private model of technology development. Legal instruments alone, particularly at the international level, do not generally determine where a practical innovation strategy for a specific new technology is, or should be, located on this spectrum, and other factors typically guide choices about the mix of public and private inputs, and the management of technology.

One key feature of the innovation landscape, however, is the dividing line between “pre-competitive” and competitive inputs to innovation. Landmark research projects such as the Human Genome Project9 and the International HapMap Project10 have sought to define a pre-competitive body of data that is openly shared for wide use in research and in the development of inputs at an early stage in the product development pipeline – so as to provide a common platform for companies to compete in the development of finished products. At a later stage along the R&D pipeline, a degree of competition and differentiation between companies can promote a greater diversity of available technologies (Olson and Berger, 2011). While the idea of a “pre-competitive” information platform of knowledge was a common theme in public-sector innovation models around 2000, the same concept has increasingly formed part of the innovation strategies of established private-sector research-based companies.

Box 3.3. New innovation models in practice: tailoring a meningitis vaccine for Africa |

The successful 2010 MenAfriVac launch highlights the role of new approaches to innovation and product development in order to address the health needs of developing countries. Prior to this, vaccines were available for various strains of meningitis, but they were too expensive for those living at risk of the disease in the so-called African meningitis belt. Moreover, they did not offer an appropriate solution for resource-poor settings. Against a background of recurrent epidemics and increasing death rates, stakeholders faced a significant innovation challenge in order to ensure the production of a vaccine that would be suitable from a clinical point of view, and would also be sustainable and affordable. The Meningitis Vaccine Project, a consortium led by the WHO and the Programme for Appropriate Technology in Health (PATH), a not-for-profit health technology organization, set about producing a vaccine for the A strain of meningitis that would cost no more than US$ 0.50 per dose. A review of options led to a decision to develop a production process and to transfer the relevant technology to a low-cost producer in the developing world, rather than subsidizing a vaccine manufacturer in the industrialized world to undertake development and production. An innovative model for vaccine development was established, with key raw materials sourced in India and the Netherlands. The technology developed by the US FDA Center for Biologics Evaluation and Research, and the technology and know-how, was transferred to Serum Institute of India Ltd to produce vaccines for clinical trials and, ultimately, for full-scale production. This development model reportedly cost one tenth of the conventional estimate for producing a new vaccine. The development and introduction of this new vaccine marks a huge step towards the elimination of epidemic meningitis in sub-Saharan Africa.11 |

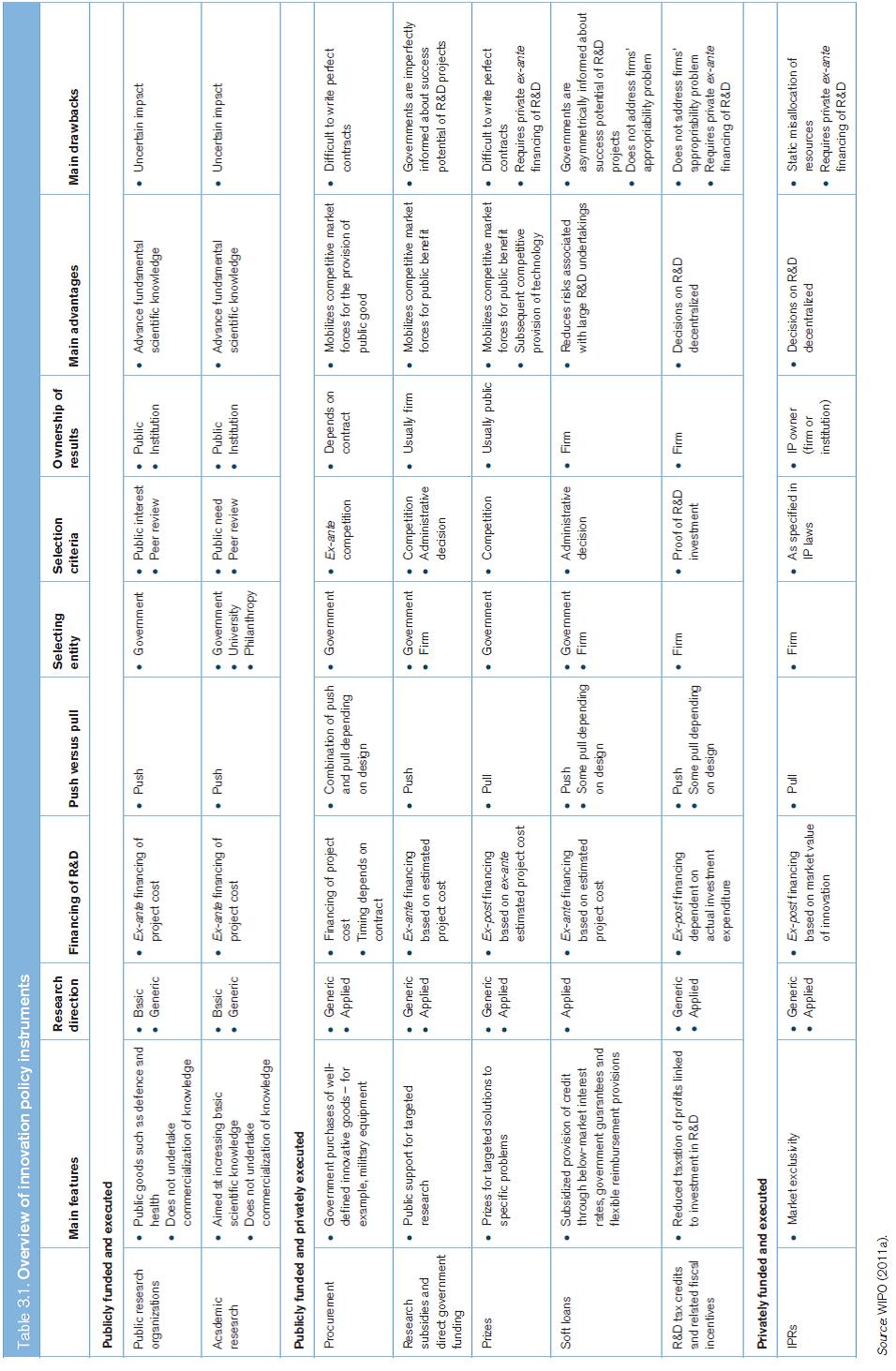

Policy instruments have significant impact on how innovation takes place. Table 3.1 sets out the different characteristics of the main innovation policy instruments, and illustrates how they differ according to whether they are addressing publicly funded and executed research, publicly funded but privately executed research, as well as privately funded and executed research.

Box 3.4. African network for drugs and diagnostics innovation |

ANDI is an African-led innovation network that provides a time-efficient and cost-effective approach to achieving the overarching goal of linking innovation to development in the field of pharmaceuticals and health (Nwaka et al., 2010).12 Its vision is to create a sustainable platform for R&D innovation in Africa, in order to address Africa’s specific health needs. The implementation of ANDI is linked to the GSPA-PHI. In this context, ANDI is developing a focused strategy for the management of IP, both in the context of training and in the area of specific projects. Specific goals: |

|

|

|

|

|

|

Highlights of progress to date: |

|

|

|

|

|

The establishment of ANDI is supported by several African institutions, the WHO through TDR, the WHO Regional Office for Africa (AFRO) and the WHO Regional Office for the Eastern Mediterranean (EMRO), UNECA, the European Commission and the African Development Bank. |

(e) Vaccines: a distinct challenge for innovation

Vaccine development differs from the development of small-molecule, chemically synthesized pharmaceuticals. Vaccines are complex biological entities and there is no such thing as a “generic” vaccine. Proving the safety and efficacy of a vaccine, even if it is a “copy” of an existing vaccine, requires a full regulatory dossier containing data on pre-clinical and clinical trials. This adds years, and complexity, to the process of making and copying even existing vaccines. Vaccines are typically given to healthy individuals and, in particular, to healthy infants as a prophylaxis against a subsequent infection. Safety is therefore paramount, and any remote suggestion of risk to the recipient can result in withdrawal or non-authorization of the vaccine.

The cost of establishing and gaining regulatory approval for a manufacturing facility partly explains the limited number of manufacturers entering the field of vaccines and the relatively small number of qualified products and producers. Other reasons include the lack of production know-how that can constitute an effective barrier to the viable reproduction of vaccine technologies. Vaccines also often require costly cold-chain infrastructure and only a relatively small number of doses are required to achieve immunization. Thus, profit margins can be relatively low in comparison with other pharmaceuticals.

These challenges mean that private manufacturers have long lacked the necessary incentives to invest in vaccines, particularly those that focus on the specific needs of developing countries. Almost all the important, innovative vaccines introduced during the past 25 years have resulted from initial discoveries made by public-sector research institutions (Stevens et al., 2011).

(i) New vaccine innovation in the 21st century

The first decade of the 21st century brought a record number of new vaccines, including vaccines for meningococcal meningitis, rotavirus, pneumococcal disease and cervical cancer caused by human papillomavirus. At the same time, the market for vaccines has grown dramatically. It has tripled since 2000, and had reached over US$ 17 billion globally by mid-2008 (WHO/UNICEF/World Bank, 2009).

This increase in the development of vaccines is due to a number of key factors: more innovative technologies; improved understanding of immunity; investment by PDPs such as the GAVI Alliance,13 and, more recently, new funding sources and mechanisms such as advance market commitments, which contribute to public funding for vaccine development (see Box 3.5). These changes continue to shape the current landscape of vaccine manufacturers.

(ii) Role of developing-country manufacturers

The vaccine industry has undergone major changes in the past decades. The market share of a small number of multinational companies grew from approximately 50 per cent (in terms of sales revenue) in 1988 to about 70 per cent of sales revenue in 2005. Overall, there are fewer than 40 vaccine suppliers, with over 90 per cent of all vaccines produced by only 15 manufacturers (WHO, 2011c).

However, due to liability and regulatory compliance issues, or as a result of mergers and acquisitions, developed-country manufacturers are increasingly leaving the vaccine market. Small- and medium-sized companies, together with emerging companies in Brazil, India, Indonesia and the Republic of Korea comprise about 10 per cent of the market in terms of value (Milstien et al., 2005). However, in terms of volume of production, developing country vaccine manufacturers contribute a larger share.14 Developing country vaccine manufacturers are also increasingly investing in research. For example, the Serum Institute of India has developed a meningitis A vaccine for use in sub-Saharan Africa (see Box 3.4), as well as a measles vaccine delivered by aerosol.15 Cuba has a vibrant research-based biotechnology industry that has developed a number of innovative vaccines, including a meningitis B vaccine and a synthetic haemophilus influenza B vaccine.16 It also has numerous innovative products in the pipeline. A Chinese company has developed a hepatitis E vaccine: this company is currently developing a cervical cancer and a genital warts vaccine.17 In Brazil, the Oswaldo Cruz Foundation (Fiocruz), through its Immunobiological Technology Institute (Bio-Manguinhos), supplied 47 per cent of the vaccines acquired by the Brazilian National Immunization Program in 2007. Bio-Manguinhos currently has 25 projects under development: 13 involving bacterial or viral vaccines.18 Also in Brazil, the Butantan Institute, which held 51 per cent of the market share for vaccines in Brazil in 2010, has developed a novel adjuvant derived from a by-product of pertussis vaccine production.19

5. Registration of clinical trials in pharmaceutical product development

Registration of clinical trials means making accessible to the public, by means of a registry, an agreed set of information about the design, conduct and administration of clinical trials.20 A clinical trials registry is a publicly accessible database containing entries with information about the design, conduct and administration of clinical trials.

Box 3.5 Advance market commitment: saving lives through vaccines |

Although vaccines are among the most effective public health interventions, few of the vaccines that have been developed address diseases that primarily affect the developing world. In the past, new vaccines typically reached low-income countries only decades after they had been rolled out in developed countries. A pilot project on an Advance Market Commitment (AMC) for pneumococcal vaccines was launched in 2007. It was funded by Canada, Italy, Norway, the Russian Federation, the United Kingdom and the Bill & Melinda Gates Foundation. Pneumococcal disease was selected for this project, as it claims 1.5 million lives each year, mostly children in Asia and Africa. |

The AMC guarantees a market to manufacturers of a novel and suitable pneumococcal vaccine, with a high introductory price of US$ 7 for each dose. This price is guaranteed for about 20 per cent of the doses that manufacturers commit to sell through the AMC and is designed to help them recover the costs of establishing production capacity. In return, manufacturers have accepted to provide additional doses at a “tail price” of US$ 3.50 for at least a decade. |

Under the oversight of the World Bank and the GAVI Alliance, the AMC, in conjunction with UNICEF, issued the first tender in September 2009. Since then, two pharmaceutical companies have committed to each provide 30 million doses of a pneumococcal conjugate vaccine (PCV) annually and the vaccines have been successfully launched. |

In December 2010, Nicaragua became the first country to immunize its children with the new vaccine. Since then, 15 other countries – Benin, Burundi, Cameroon, the Central African Republic, the Democratic Republic of the Congo, Ethiopia, The Gambia, Guyana, Honduras, Kenya, Malawi, Mali, Rwanda, Sierra Leone and Yemen – have added the AMC-purchased vaccine to their national vaccination schedules.21 |

The WHO maintains the International Clinical Trials Registry Platform (ICTRP).22 The ICTRP Search Portal (222,000 records as of 29 October 2012) provides a searchable database containing the trial registration datasets made available by 14 national registries meeting criteria for content and quality control. These datasets constitute international standards for clinical trials registration. The platform also has the unique ability to link together (bridging) records registered in different countries (or multi-country trials). Currently, the ICTRP database has 63,203 records for recruiting trials. It is updated weekly.

The WHO considers the registration of all interventional trials a scientific and ethical responsibility. The rationale for the ICTRP includes the following considerations:

- Decisions about health care should be informed by all of the available evidence. .

- Publication bias and selective reporting make informed decisions difficult.

- Improving awareness of similar or identical trials enables researchers and funding agencies to avoid unnecessary duplication.

- Describing clinical trials in progress can make it easier to identify gaps in clinical trials research and to define research priorities.

- Making researchers and potential participants aware of trials may facilitate recruitment and increase patients’ active involvement in the clinical trial process.

- Enabling researchers and health care practitioners to identify trials in which they may have an interest could result in more effective collaboration among researchers, including prospective meta-analysis.

- Registries checking data as part of the registration process may lead to improvements in the quality of clinical trials by making it possible to identify potential problems early in the research process.

There are other national and regional initiatives for capacity-building in developing countries, such as the European and Developing Country Clinical Trials Partnership (EDCTP), which aims to accelerate the development of new or improved drugs, vaccines, microbicides and diagnostics against HIV/AIDS, malaria and TB, with a focus on Phase II and Phase III clinical trials in Africa. It supports projects which combine clinical trials, capacity-building and networking. Various European countries operate in partnership with over 40 countries in Africa (EDCTP, 2011).

Besides the registration of clinical trials, the publication of the results of clinical trials is equally important for public health. Patients take part in clinical trials in the hope that they will contribute to advances in medical science and they do this altruistically. Participants expect that results are used to further scientific research. Sponsors of clinical trials will often not provide details of clinical trials that have failed, although this is valuable knowledge and could be used help to prevent a repetition of such trials, and thus help to avoid exposing patients to unnecessary risks. It would be in the interest of public health if the details of all clinical trials were to become publicly available, allowing interested parties to verify the data. The European Medicines Agency (EMA) intends to provide access to clinical trial data, allowing interested parties to verify the data (see Box 3.6).

Box 3.6. European medicines Agency to make available clinical trials data |

In December 2010, the EMA adopted a new policy of public access to EMA documents.23 In response to a number of safety-related requests received since 2010, the EMA has granted access to 1.5 million pages of clinical trial data. During the second phase of implementation, the EMA intends to proactively publish clinical trials data that applicants submit to the agency within the framework of the authorization process. The purpose of this initiative is to provide access to full datasets for interested parties, allowing them to verify the clinical data produced and submitted by companies in justification of the quality, safety and efficacy of products. The disclosure of such data is considered to be in the public interest, as it allows independent researchers and other interested groups to screen the raw data and to assess for themselves the efficacy and potential side effects of the product. The modalities of providing such proactive access to clinical trial data are under consideration (see EMA, 2012; Reuters, 2012). The new policy is expected to enter into force in January 2014.24 |

1. Source: GE Healthcare (2011) and Immelt et al. (2009). back to text

2. Source: www.britannica.com/EBchecked/topic/1357082/pharmaceutical-industry/260283/History; and Newman et al. (2008). back to text

3. See http://patestate.com/category.htm. back to text

4. See http://ec.europa.eu/competition/sectors/ pharmaceuticals/inquiry/communication_en.pdf. back to text

5. See www.phrma.org/issues/intellectual-property. back to text

6. WHA, Resolution: WHA61.21: Global strategy and plan of action on public health, innovation and intellectual property, para. 7. back to text

7. For more information, see Chapter III, Section C. back to text

8. Ibid. back to text

9. See www.ornl.gov/sci/techresources/Human_Genome/home. shtml. back to text

10. See http://hapmap.ncbi.nlm.nih.gov/index.html.en. back to text

11. Source: www.meningvax.org. back to text

12. See www.andi-africa.org. back to text

13. For more information, see Chapter IV, Box 4.3. back to text

14. See www.economist.com/node/18836582. back to text

15. See www.seruminstitute.com/content/research.htm; and www.who.int/immunization_delivery/new_vaccines/ technologies_aerosol/en/. back to text

16. See www.cigb.edu.cu. back to text

17. See www.innovax.cn. back to text

18. See www.fiocruz.br/bio_eng/cgi/cgilua.exe/sys/start.htm?tpl=home.

19. See www.fapesp.br/week/media/pres/kalil.pdf. back to text

20. The legal background and the policy issues around the legal protection of pharmaceutical test data are set out in Chapter II, Section B.1(c). back to text

21. Source: Ker (2012). back to text

22. WHA, Resolution: WHA58.34: Ministerial Summit on Health Research. ICTRP website at http://apps.who.int/trialsearch/. back to text

23. EMA, “European Medicines Agency Policy on Access to Documents (Related to Medicinal Products for Human and Veterinary Use)”, Policy/0043, 2010. back to text

24. EMA, “Workshop on Access to Clinical-Trial Data and Transparency Kicks Off Process Towards Proactive Publication of Data”, Press release, 23 November 2012. back to text