NOTE:

THIS NEWS STORY is designed to help the public understand developments in the WTO. While every effort has been made to ensure the contents are accurate, it does not prejudice member governments’ positions.

MORE:

> Cotton, including the sub-committee

> Agriculture negotiations: www.wto.org/agnegs

> Development: www.wto.org/development

KEY DOCUMENTS:

> “Evolving table” on aid: WT/CFMC/6... series

> Domestic cotton sector reform: WT/CFMC/21... series

> Documents and meetings lists: WT/CFMC/W/24... series

> All documents: WT/CFMC... series

Need help on downloading?

> Find help here

Presentations by several of these organizations were made as the WTO Secretariat reported a slight decline in assistance for cotton — current and future — as a number of projects have been completed.

And members were urged to be more active in consultations on reviving the stalled negotiations on reforming trade in agriculture and cotton. In his latest report, the negotiations’ chairperson, Ambassador John Adank of New Zealand, said “the level of engagement among members is still clearly not as advanced as it needs to be.”

Members have discussed the pros and cons of sticking to the current draft text (the draft “modalities”), which has been on the table since 2008, but no specific proposals have been made, he said. A meeting on the cotton in the agriculture negotiations was held that same afternoon.

Consultative framework. This meeting on development was the 21st in a series of consultations held regularly since 2004, formally called the WTO “Director General’s Consultative Framework Mechanism on Cotton”. The chairperson is Deputy Director-General David Shark, on behalf of Director-General Roberto Azevêdo.

Although the official focus is primarily on development assistance, the meeting also receives regular updates on the separate negotiations on cotton, and the agriculture negotiations as a whole, and on world market trends.

South-South cooperation. “South-South cooperation continues to emerge as an important aspect of the implementation of the mandate on the development assistance aspects of cotton and our work in this forum,” chairperson David Shark said.

“There is wide recognition of this important dimension of our work. The significant contributions of Brazil, China and India as well as Pakistan, are acknowledged with appreciation. This is an area of the work which Members and participants are encouraged to continue to deepen and extend.”

He concluded: “Director-General Roberto Azevêdo will continue to place a full spotlight on the cotton issue, building on the momentum of this collaborative process, where all parties are engaging in partnership, enhancing the dialogue and improving the exchange of information. All this makes this process a positive example of constructive engagement in the development dimension of the work in the WTO.”

Some details

back to top

Regional efforts: presentations

The regional organizations presenting their work in cotton development were:

- The Economic Community of Central African States (Communauté Économique des États de l’Afrique Centrale, CEEAC-ECCAS) — presentation here (in French)

- The Common Market for Eastern and Southern Africa (COMESA) — presentation here (in English)

- The West African Economic and Monetary Union (Union économique et monétaire ouest-africaine, WAEMU or UEMOA ) — presentation here (in French)

They presented in some detail the conditions in their regions and their approach to developing the cotton sector. These included policies to deal with the problem of poorer farmers not receiving aid, increasing productivity, boosting production further along the value chain so that countries no longer rely on exporting raw materials, and involving the private sector.

back to top

Development assistance

he value of completed development assistance projects benefiting cotton — directly or through broader agricultural or infrastructure assistance — has increased since the last meeting in October 2013 by about $369m, which partly explains the slight decline in actual and intended spending on current projects (see table below) — a fall that disappointed some African delegations.

Members heard that $489 million in development assistance has been disbursed specifically for cotton — $397m in completed projects and $92m in on-going activities. This is a slight increase over the $459 million total disbursement reported at the last meeting.

However, the amount spent so far on current projects that are specific to cotton is 28% of the $336m committed. Donors have in the past explained that the apparently low proportion is partly because of timing: when the commitments were made, how long the projects last, what stage they are in, and when payments are made.

A further $4.4bn — a $700m increase since October — has been spent on completed or continuing projects for agriculture and infrastructure, which also benefits cotton, in these cotton producing countries.

“The reason behind these figures is that new projects have been initiated and many others have been completed,” the WTO Secretariat observed. Improved reporting and the how the compiled data evolves “have resulted in an increase in the gap between commitments and disbursements” in programmes that are specific to cotton, it said.

“It is useful to note that the widening gap is a consequence, not only of new projects having been initiated, but also because we have not received any updates on long-standing projects from certain donors,” the Secretariat said, reminding the donors that the information is crucial to make the compilation as meaningful as possible.

Development assistance for cotton and agriculture, US$m

|

ACTIVE, ON-GOING | COMPLETED | ||

|

Committed | Spent | Committed | Spent |

Specifically for cotton |

335.6 | 92.5 | 420.1 | 397.4 |

For agriculture and infrastructure, also benefiting cotton |

4,784.0 | 2,624.3 | 1,854.1 | 1,822.2 |

| Total | 5,119.6 | 2,716.8 | 2,274.2 | 2,219.6 |

The information is compiled in a document that is regularly updated, an “evolving table” now in its 17th version (document WT/CFMC/6/Rev.16 of 26 May 2014, with this covernote).

back to top

Market situation

In its latest assessment of the cotton market, the International Cotton Advisory Committee (ICAC) included an analysis of technological development and technology transfer, cotton logistics in Africa and world cotton production and stocks.

ICAC said the increase in yields in cotton has been slower than in other crops, and technology transfer has lagged behind developments in research. Despite that, farmers are receptive to learning new methods. Therefore a number of issues need to be tackled, ranging from training trainers and better communications to improved collaboration between the private and public sectors and a new focus on the interaction of inputs, it said.

On logistics, ICAC said inland transport and transit costs tend to be higher in Africa than in competing areas. The costs and transit time are the two key issues hindering the efficient movement of cotton and cotton products, and therefore further research is needed on these costs from farm to gin, ICAC said.

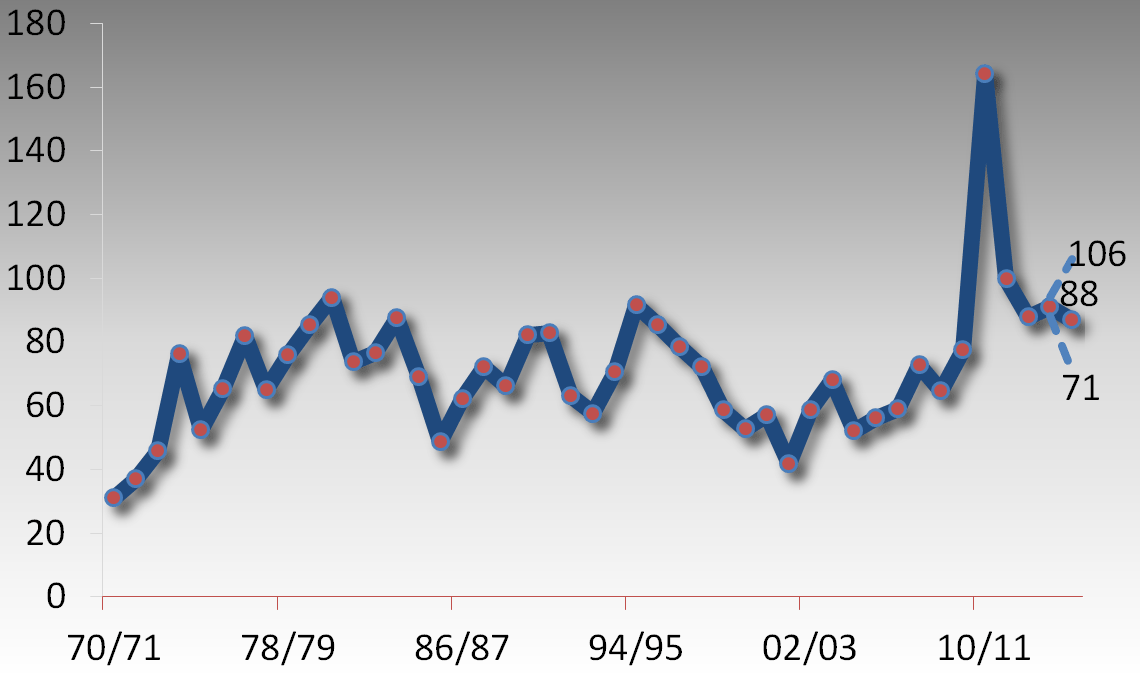

Meanwhile, in world markets, cotton prices have stabilized compared to the peak of 2010/2011. The high level of world cotton stocks, particularly in China are having an impact on global price, and world production continues to exceed mill use, ICAC said. The presentation is here.

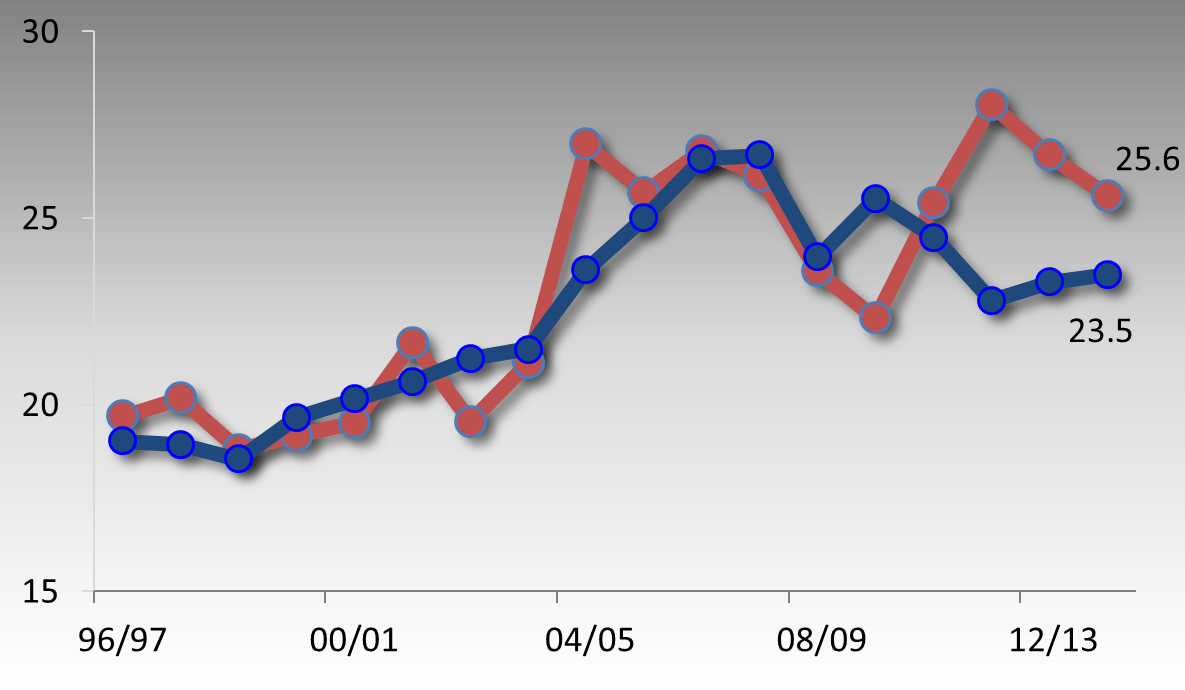

World cotton production & mill use

Million tonnes

― Production ― Mill use

Source: ICAC

Cotton prices (Cotlook A Index)

US cents/lb

Source: ICAC Cotton Outlook

back to top

Trade negotiations

Meanwhile, Ambassador John Adank of New Zealand, the chairperson of the negotiations on agriculture and cotton reported on consultations he has been holding on a number of issues in the agriculture negotiations before specifically addressing cotton. These are his speaking notes:

![]() As is customary, I will start with a brief state of play in agriculture in general.

As is customary, I will start with a brief state of play in agriculture in general.

As you are all aware, in Bali Ministers issued one declaration and four decisions on agriculture, dealing with: Export Competition, General Services, Public Stockholding for Food Security Purposes, Tariff Rate Quota Administration Provisions, and Cotton.

At its January and June 2014 meetings, the regular Committee on Agriculture started discussing the implementation of the decisions on TRQ administration and on public stockholding. In the case of export competition, the first dedicated discussion foreseen in the Bali Ministerial declaration took place during the 5 June 2014 meeting of the Committee on Agriculture.

The Bali Ministerial Declaration also instructed the Trade Negotiations Committee to prepare within this year a clearly defined work programme on the remaining DDA issues. It is in that context that I have undertaken consultations in various configurations, including an open ended informal meeting of the Special Session on Friday, 28 March 2014. I circulated a report on 14 March (JOB/GC/61 and TN/AG/27) that provides a summary of the feedback I received up to that date in my consultations along with my observations.

More recently, the Chair of the Trade Negotiation Committee summarized the state of play of the negotiations during the General Council of 12 May (JOB/GC/68). Discussions have taken place in various formats since then, and the Trade Negotiation Committee scheduled on 25 June will be the next occasion to have an overall debate on the state of play of the post Bali negotiations.

Overall, my consultations have shown a general willingness to work constructively. However, there is still not yet sufficient engagement on concrete issues. The level of engagement among Members, or at least those whose interests are most directly involved, is still clearly not as advanced as it needs to be to have a clear understanding of both the issue and what members are seeking in regard to it.

As I already indicated several times, that will only come with further direct engagement between Members. And whether any agreed pathway forward emerges will again be dependent on the willingness of Members to consider options for dealing with these issues.

Let me comment briefly on the three pillars of the agriculture negotiations. Export Competition remains an area where I think the range of questions or concerns appears to be somewhat less than in other areas. This does not mean it is easy. However we do have agreed direction for ongoing work from Ministers at Bali, and my consultations have not shown any questioning whatsoever of the political commitment that Ministers have repeatedly reiterated to the “parallel elimination of all forms of export subsidies and disciplines on all export measures with equivalent effect”.

On Domestic Support, points that have come up in the consultations include: (i) the relationship of an overall agreement on domestic support to the work for a permanent solution to the public stockholding for food security issue which was mandated at Bali for decision by 2017; (ii) the changing patterns of domestic support and subsidisation in the years since the negotiations were last active, and particularly the increased role that domestic support now plays in some emerging economies.

Concerning Market Access, some Members have indicated that they do not see the framework discussed in the past — in terms of the results arising from the formula and flexibilities provided under it — as delivering an acceptable landing zone in terms of improved market access.

More generally, some Members have indicated that a less complex approach, which accommodates appropriate ambition and flexibilities, would be desirable. Some other members insisted on the fact that, no matter the approach, it had to deliver real and significant improvement in market access. At this stage, no one has in fact come forward with a specific alternative here.

As against all of this, some other Members have indicated a concern to keep any focus on market access issues on the resolution of the “outstanding issues” identified in this area back in the Chair’s 2011 Easter report, including the unresolved issues around sensitive/special products and the SSM. There is now an urgent need to be moving into the less comfortable, but hopefully more productive, zone of testing each other’s — and our own — capacity to contribute to putting forward more concrete suggestions and proposals, with a view to agreeing on a clearly defined work programme by the end of the year.

I will continue to work in full respect of transparency and inclusiveness. I will schedule a further informal meeting of the Special Session at an appropriate time to report, and I remain available to any delegation that wishes to contact me in the meantime.

State of Play in the Cotton Negotiations

Let me now turn specifically to cotton. As you are all aware, thanks to substantive preparatory work with the participation of several key players, and based on a proposal tabled by the Cotton‑4 (TN/AG/GEN/33 and Corr.1, refers), cotton was the subject of a specific decision by Ministers in Bali.

The Bali Ministerial Decision on Cotton ((WT/MIN/(13)/41 and WT/L/316 refers) addresses both the trade and development aspects of the WTO mandate on cotton, and constitutes a step in the right direction in our ongoing efforts to meaningfully reform cotton trade in the context of the DDA agriculture negotiations.

Indeed, Ministers reaffirmed their commitment to address cotton “ambitiously, expeditiously and specifically” within the agriculture negotiations and to increase Members’ work towards reform as per the August 2004 Decision, the 2005 Hong Kong Ministerial Declaration and the 2011 Ministerial Conference. While Ministers regretted the failure so far to reach an agreement on a final outcome, they remain committed to further work and progress in cotton, based on the above-mentioned frameworks, with the 2008 revised draft agriculture modalities providing a reference point for that work.

In this context, Ministers agreed to enhance transparency and monitoring in relation to trade related aspects of cotton. To that effect, Ministers agreed that twice a year, Members will discuss, within the special session of the Committee on Agriculture, trade-related developments for cotton particularly in the areas of market access for LDCs, domestic support and export competition. The dedicated discussions will be based on factual information and data compiled by the WTO Secretariat from Members’ notifications with, as appropriate, additional relevant information provided by Members.

As you know, the first such dedicated discussion is scheduled for this afternoon in this room. Hence my intention is to keep any discussions of the trade aspects this morning brief since we will have an opportunity to discuss in detail the trade aspects of cotton during our dedicated discussion this afternoon.

You will all have seen my invitation fax of 20th May and the proposed agenda contained therein namely: (i) Introductory Remarks by the Chairman; (ii) General Statements from Members; (iii) Discussion of Trade-related Developments in Market Access, Domestic Support and Export Competition for cotton (Background Paper by the Secretariat and Information and Submissions from Members); and (iv) Any Other Business. Please note that the Secretariat background paper was circulated to all Members in the 3 working languages on 10 June (TN/AG/GEN/34; TN/AG/SCC/GEN/13).

The dedicated discussion on cotton of this afternoon is the first concrete step of one clear deliverable from the Bali Ministerial outcome. It will therefore constitute an important event in the context of the wider post Bali agenda. Cotton will of course be an important element of the reflection on the possible way forward for our unfinished DDA business, and I will continue to reach out to concerned Members to see how best deliver on the cotton mandate within the framework of the Doha agricultural negotiations.

I thank you ![]() for your attention and look forward to seeing Members and Observers governments this afternoon for our First Dedicated Discussion of Cotton Trade-related Developments.

for your attention and look forward to seeing Members and Observers governments this afternoon for our First Dedicated Discussion of Cotton Trade-related Developments.

Chairperson: Deputy Director-General David Shark, on behalf of Director-General Roberto Azevêdo.

Next meeting

Towards the end of 2014, date to be announced

Cotton has been a key issue in the agriculture negotiations and in development issues related to the WTO since 10 June 2003 when it was raised by Burkina Faso President Blaise Compaoré on behalf of the Cotton-4 (Benin, Burkina Faso, Chad and Mali) in a meeting of the Trade Negotiations Committee, which oversees the Doha Round negotiations.

These consultations on the development aspect of cotton have been described as unique in the WTO because they deal with a single commodity, and do so monitoring aid (particularly for least-developed countries), trade, market conditions and other aspects.

They are also separate from the negotiations on reforming cotton trade under the Doha Round agriculture negotiations, the two forming a dual track under the same mandate: the 1 August 2004 General Council decision in the Doha Round — paragraph 1(b) — and the 2005 Hong Kong Ministerial Conference’s declaration.

The first meeting on development assistance for cotton was in October 2004.

Meanwhile, successive chairs of the agriculture negotiations have said repeatedly that there will be no deal in agriculture if there is no deal in cotton.

The Cotton-4 (C-4) are supported by a number of other members and groups of members

> Problems viewing this page?

Please contact [email protected] giving details of the operating system and web browser you are using.